Price expectations soar as sentiment sinks 48% of respondents spontaneously mention tariffs

Summary

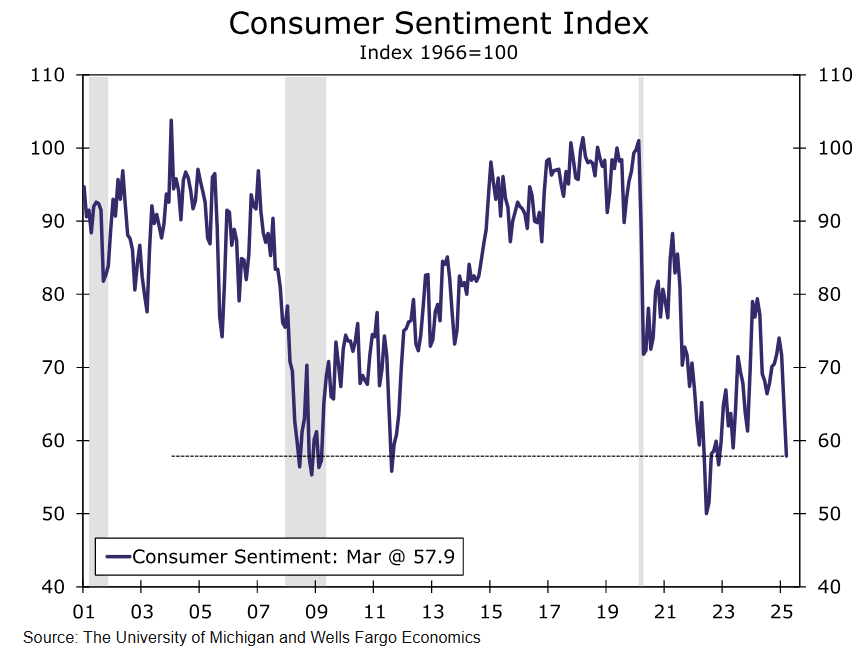

Consumer sentiment has not been this low since the high-inflation days of 2022. Unlike that era, however, consumers now see rising prices as more than passing phase. In a sign of this entrenched expectation, long-term inflation expectation rose to its highest since 1993.

Livin' on the edge

Consumer sentiment fell for the third consecutive month to reach 57.9 in March. In data going back 40 years, sentiment has only been lower a handful of times during the height of the financial crisis and during the inflation pain of 2022 (chart). Forty-eight percent of survey respondents spontaneously mentioned tariffs during interviews. While hard economic indicators have not yet fully captured the fallout from an ever-changing trade policy framework, today's ugly assessment of consumer sentiment joins similar assessments for the business sector. The National Federation of Independent Businesses has reported rising uncertainty and the Business Roundtable reported earlier this week that CEO confidence has ebbed to levels last seen around this time a year ago.

Author

Wells Fargo Research Team

Wells Fargo