Pound jumps as inflation eases

The British pound is in full flight on Wednesday. In the North American session, GBP/USD is trading at 1.2393, up 0.86%.

UK inflation slows

UK inflation eased for a second straight month in December. Headline CPI dipped to 10.5%, down from 10.7% in November and just below the forecast of 10.6%. Core CPI, however, did not show an improvement as it remained unchanged at 6.3%.

The downtrend is welcome news, but inflation still remains stubbornly high after hitting 11.1% in October, a 41-year high. The Bank of England has raised rates to 3.50% but clearly, more work needs to be done. The labour market remains robust, with wage growth climbing to 6.4% in December, up from 6.2% in November and brushing past the forecast of 6.1%. This is well below inflation levels, much to the chagrin of workers, but it is much too high for the BoE, which is focussed on curbing inflation. The BoE meets next on February 2nd and the markets have priced in a second-straight 50-bp increase. The BoE will also release updated economic forecasts, which could play a key role in the central bank’s rate policy over the next several months.

US consumers cut back on spending in December for a second consecutive month. Retail sales fell 1.1%, driven lower by a decline in vehicle sales due to rising interest rates for vehicle loans, as well as lower gas prices. This was lower than the November reading of -1.0% and the consensus of -0.8%. Core retail sales also declined by -1.1%, compared to -0.6% in November and the forecast of -0.8%. The disappointing numbers have sent the US dollar lower against the majors, as speculation rises that the Fed may have to ease up on the pace of rate hikes due to a weakening economy.

GBP/USD technical

-

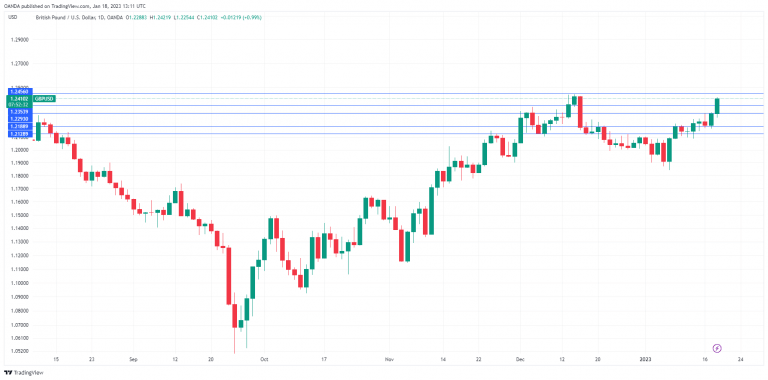

GBP/USD has pushed above resistance at 1.2292 and 1.2352. The next resistance line is at 1.2455.

-

There is support at 1.2189 and 1.2129.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.