Patterns: USD/RUB, EUR/RUB, light.CMD/USD, brent.CMD/USD

USD/RUB 1H Chart: Upside potential could prevail

The USD/RUB currency pair has been extending gains gradually since the beginning of June after it reversed north from the 68.00 level.

Given that the exchange rate is supported by the 55-, 100– and 200-hour moving averages, it is likely that some upside potential could continue to prevail in the market. A possible upside target is the Fibo 23.60% at 75.68.

Meanwhile, note that the currency pair would have to exceed the Fibo 38.20% at 71.85. If the given level holds, it is likely that the pair could consolidate in the medium term.

EUR/RUB 1H Chart: Descending channel in sight

The EUR/RUB exchange rate has been trading downwards within a descending channel since the beginning of April.

From a theoretical point of view, it is likely that the currency pair could continue to trade within the given channel in the medium term. In this case the pair could decline below the 76.00 level by the end of July.

Meanwhile, note that the exchange rate could gain support from the 55-, 100– and 200-hour SMAs. Thus, some upside potential could prevail. In this case the rate could target the psychological level at 90.00.

LIGHT.CMD/USD 4H: Buying signals

The light crude oil prices have surged by 6.36% since last week's trading sessions. The commodity breached the weekly and the monthly PPs at 38.93 during this period.

Technical indicators suggest buying signals on both the smaller and the larger time-frame charts. Therefore, bullish traders could continue to pressure the crude oil higher during the following trading sessions.

However, given that the BRENT.CMD/USD pair is currently trading near the bottom border of an ascending channel pattern, a breakout could occur within this week's sessions.

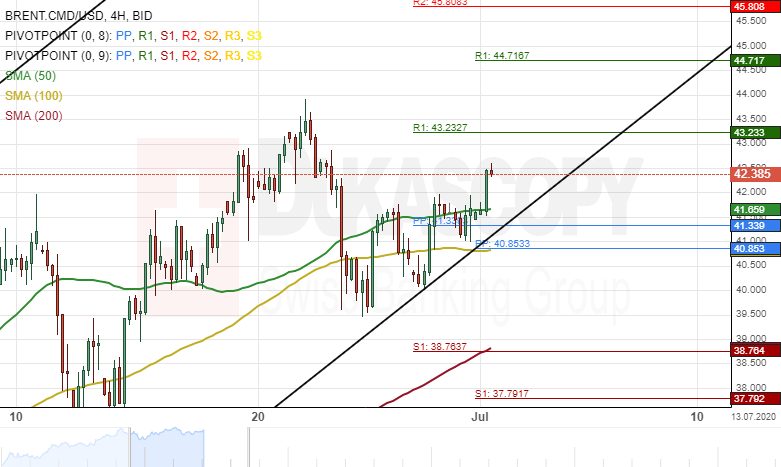

BRENT.CMD/USD 4H Chart: Two scenarios likely

The Brent crude oil prices have surged by 5.14% since last week's trading sessions. The commodity tested a resistance level formed by the 50– period simple moving average at 41.71 during the Asian session on Wednesday.

If the 50– period SMA holds, a breakout through the lower boundary of an ascending channel pattern could occur during the following trading sessions.

However, if BRENT.CMD/USD breaches the resistance level, a surge towards the $44 could be expected in the near future.

Meanwhile, technical indicators suggest bullish signals on both the smaller and the larger time-frame charts.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.