Patterns: USD/DKK, EUR/DKK, BRENT.CMD/USD, LIGHT.CMD/USD

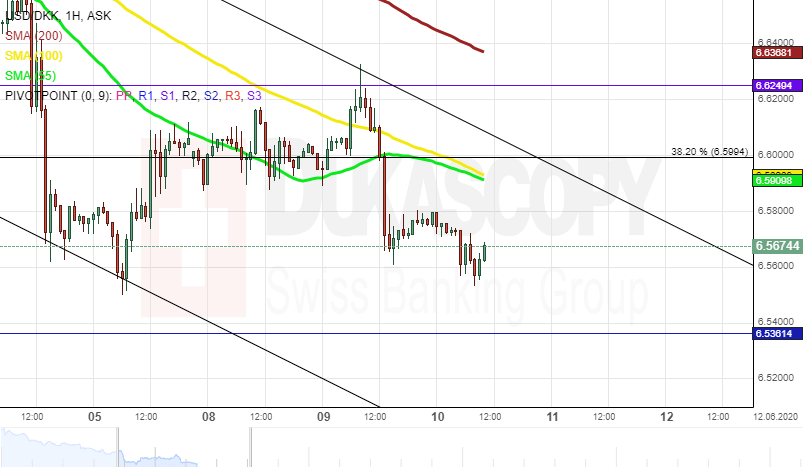

USD/DKK 1H Chart: Bears could prevail in market

The USD/DKK currency pair has been trading downwards within a descending channel since the end of May. The pair has already declined to the 6.7000 level.

Given that the exchange rate is pressured by the 200-hour moving average near 6.6590, it is likely that some downside potential could continue to prevail in the market. In this case the rate could decline to the Fibo 50.00% at 6.4753.

Meanwhile, note that the currency pair could gain support from the monthly S2 at 6.5361. If the given support holds, it is likely that a reversal north could occur and the pair could raise to the Fibo 23.60% at 6.7528.

EUR/DKK 1H Chart: Falling wedge pattern in sight

The EUR/DKK exchange rate continued to trade downwards within the falling wedge pattern. The rate has already declined below the 7.4570 level.

From a theoretical point of view, it is likely that the currency pair could continue to trade within the given pattern until the beginning of July. Then, a breakout north could follow.

However, note that the exchange rate is pressured by the 55-, 100– and 200-hour moving averages. Thus, a breakout south could occur within the following trading sessions. In this case the rate could gain support from the monthly S2 at 7.4428.

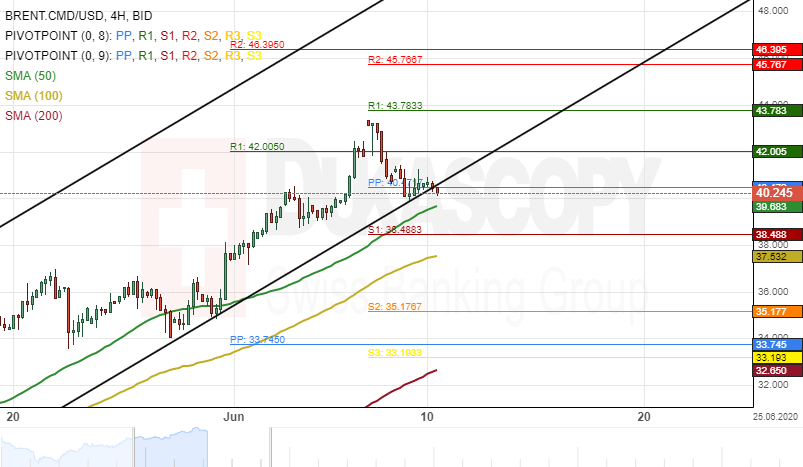

BRENT.CMD/USD 4H Chart: Two scenarios likely

During the past month, the Brent crude oil prices have been trading bullish. The commodity has surged by 124.06% since May 1.

Currently, the LIGHT.CMD/USD pair is trading near the lower boundary of an ascending channel pattern at 40.55.

If the channel pattern holds, bullish traders would continue to dominate the pair during the following trading sessions.

However, if the pair breaks the ascending channel, a decline towards the 34.00 area could be expected during next week's trading sessions.

LIGHT.CMD/USD 4H: Breakout could occur

The US light crude oil versus the US Dollar has been trading in an ascending channel pattern since May 1. The commodity has surged by 293% since the beginning of May.

As for the near future, the LIGHT.CMD/USD exchange rate could continue to trend bullish. Buyers are likely to aim for the $50 mark during the following trading sessions.

However, given that the pair is currently trading near the bottom border of the ascending channel pattern, a breakout could occur within this week's trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.