Patterns: USD/CHF, EUR/GBP, EUR/NOK

USD/CHF 4H Chart: Potential target at 0.9900

The US Dollar has declined more than 190 pips or 1.99% against the Swiss Franc since April 6. The currency pair tested the 200– period simple moving average at 0.9623 on April 16.

As for the near future, the USD/CHF exchange rate could continue to trade in the dominant ascending channel pattern. Bulls could drive the price towards the psychological resistance level at 0.9900 area.

On the other hand, the currency exchange rate might make a U-turn from the 0.9800 area and continue to trade bearish during the following trading sessions.

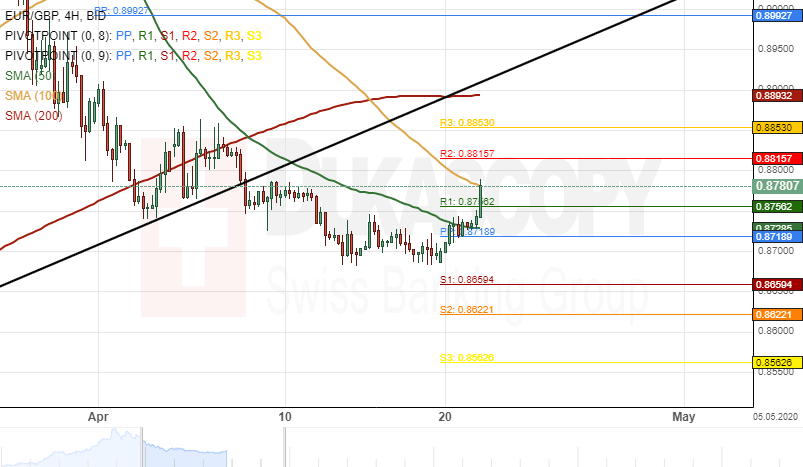

EUR/GBP 4H: Weekly buy signals

The common European currency has been trading sideways against the British Pound since April 8. The currency pair breached the lower boundary of an ascending channel pattern during this period.

Technical indicators flash buy signals on the weekly time-frame chart. Therefore, bullish traders could pressure the price towards the monthly pivot point at 0.8992 within the following trading sessions.

Although, a resistance cluster formed by the 100– period simple moving average and the weekly R1 at the 0.8784 area could provide resistance for the currency exchange rate within this week's trading sessions.

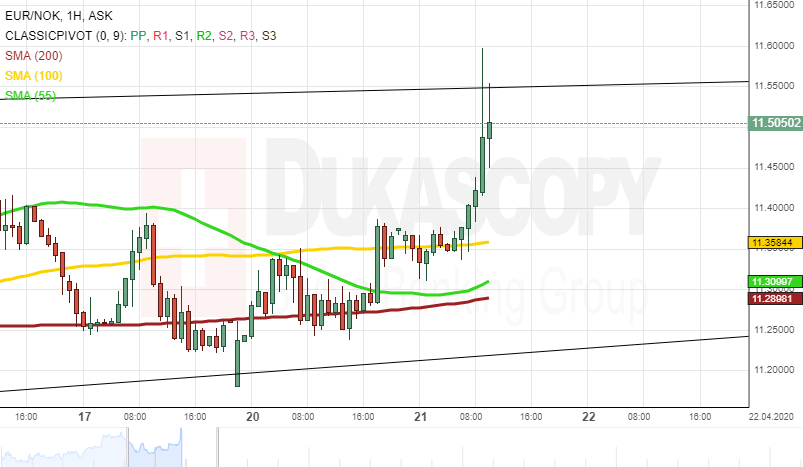

EUR/NOK 1H Chart: Rising wedge pattern in sight

The EUR/NOK currency pair has been trading within a rising wedge pattern within the beginning of April.

From a theoretical point of view, it is likely that the exchange rate could trade within the given pattern until the middle of May. Then, a breakout north could follow, and the rate could decline to the psychological level at 10.00.

On the other hand, note that the currency pair is supported by the 55-, 100– and 200-hour SMAs in the 11.30 area. Thus, the pair could breach the given pattern north and re-test the psychological level at 13.00.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.