Patterns: USD/CHF, EUR/GBP

USD/CHF 4H Chart: Breakout likely to occur

The US Dollar has surged by 129 pips or 1.34% against the Swiss Franc since May 1. The currency pair breached the 50-, 100– and 200– period SMAs during yesterday's trading session.

The exchange rate will most likely continue to edge higher within this week's trading sessions. A breakout through the upper boundary of a junior descending channel could occur.

However, a resistance cluster formed by the weekly R1 and the monthly R1 near the 0.9750 area could provide resistance for the USD/CHF currency exchange rate in the short-term.

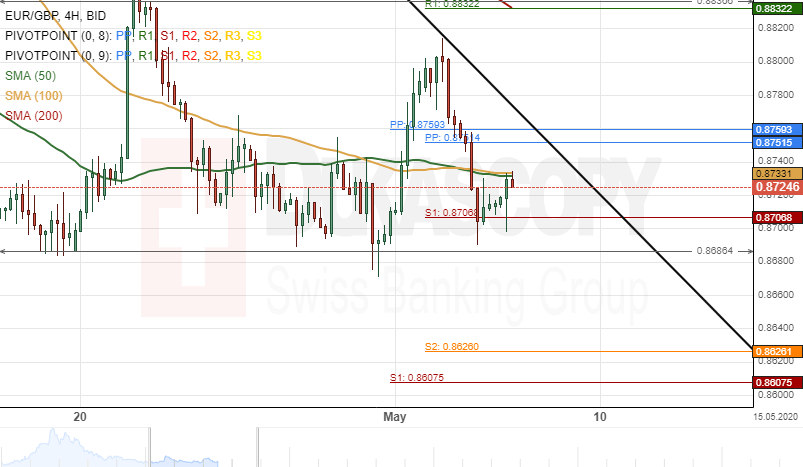

EUR/GBP 4H: Could edge higher

The common European currency has been trading between the range of 0.8836/0.8686 against the British Pound since the beginning of April.

Everything being equal, the EUR/GBP currency pair will most likely aim for the 200– period simple moving average at 0.8836 during the following trading sessions. Furthermore, technical indicators suggest a buying signal on the weekly time-frame chart.

However, a resistance cluster formed by the weekly and monthly pivot points at 0.8759 could provide resistance for the currency exchange rate within this week's trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.