Patterns: NZD/JPY, CAD/CHF

NZD/JPY likely to make a pullback

Upside risks have been dominating the NZD/JPY currency pair since the beginning of October. The New Zealand Dollar has edged higher by 7.23% against the Japanese Yen during this period.

All things being equal, the exchange rate is likely to continue to trend higher during the following trading sessions. The potential target for buyers will be near the 84.00 level.

However, the currency exchange rate might make a brief retracement towards the 79.00 area in the short term.

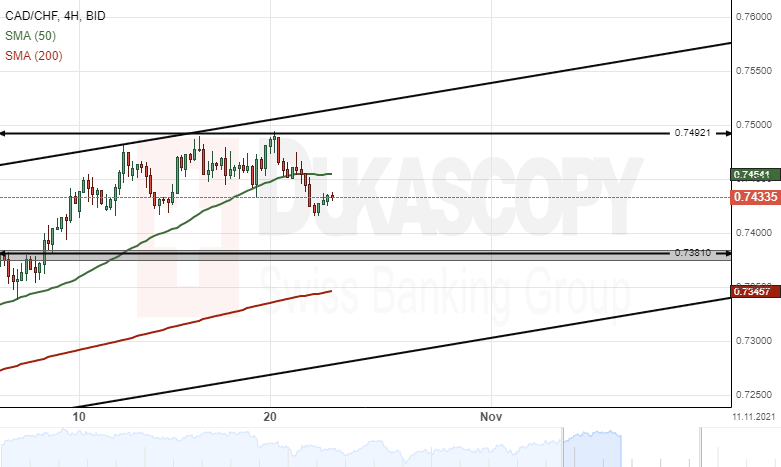

CAD/CHF could edge lower

The Canadian Dollar has surged by 1.81% against the Swiss Franc since October 8. The currency pair tested the resistance level at 0.7492 during this week's trading sessions.

Technical indicators suggest selling signals on the 4H time-frame chart. Most likely, the CAD/CHF currency exchange rate could edge lower during next week's trading sessions.

However, bearish traders might encounter a support level at 0.7381 during the following trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.