Patterns: NZD/CAD, NZD/JPY

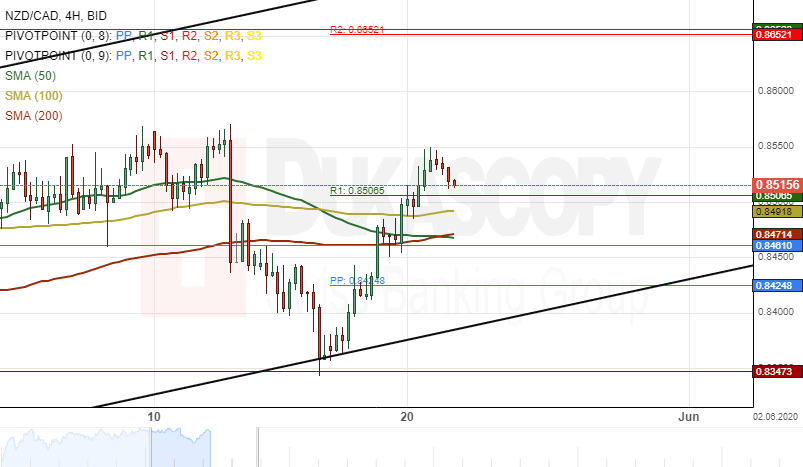

NZD/CAD 4H: Likely to continue to trend bullish

The New Zealand Dollar has edged higher by 188 pips or 2.25% against the Canadian Dollar since this week's trading sessions. The currency pair breached the 50-, 100– and 200– period SMAs on May 19.

Everything being equal, the NZD/CAD exchange rate could continue to trade bullish during the following trading sessions. The possible target for the pair would be near the monthly R1 and the weekly R2 at 0.8652.

On the other hand, the currency exchange rate could make a brief retracement towards the 50– and 200– period SMAs at 0.8469 in the shorter term.

NZD/JPY 4H Chart: Could aim at 64.96

The New Zealand Dollar has surged by 261 pips or 4.11% against the Japanese Yen since this week's trading sessions. The currency pair tested the upper boundary of a long-term descending channel pattern at 66.10 on May 20.

As for next week's trading sessions, the NZD/JPY exchange rate will most likely make a pullback towards the monthly pivot point at 64.96.

However, given that the currency exchange rate is currently trading near the upper line of the long-term descending channel pattern, a breakout could occur within the following trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.