Patterns: GBP/CHF, GBP/NZD

GBP/CHF 4H Chart: Symmetrical triangle pattern in sight

Since the end of September, the GBP/CHF currency pair has been trading sideways within a symmetrical triangle pattern.

It is likely that the exchange rate could gain support from the 55-, 100– and 200-period moving averages in the 1.1830 area. Thus, the rate could breach the given pattern north in the nearest future and target the Fibo 38.20% at 1.2181.

On the other hand, the currency pair could face the resistance level—the monthly PP at 1.1910. Therefore, the pair could breach the predetermined pattern south and target the psychological level at 1.1600.

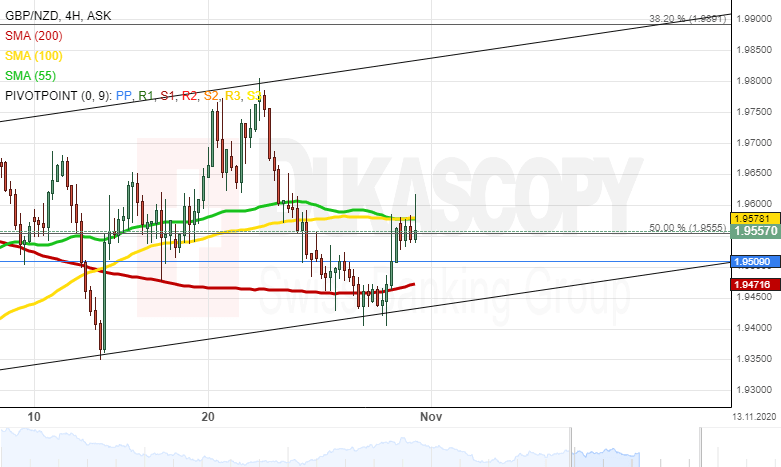

GBP/NZD 4H Chart: Two scenarios likely

Since the end of September, the GBP/NZD exchange rate has been trading upward within an ascending channel.

From a theoretical perspective, it is likely that the currency pair could continue to trade upwards within the predetermined channel in the medium term. In this case the pair could reach the Fibo 38.20% at 1.9891 by the end of November.

In the meantime, note that the exchange rate is pressured by the 55– and 100-period moving averages near 1.9580. Thus, a breakout south could occur, and the rate could target the Fibo 61.80% at 1.9218.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.