Patterns: EUR/TRY, EUR/CZK

EUR/TRY 4H Chart: Bulls could continue to prevail

The EUR/TRY currency pair has been trading upwards since the beginning of July. As apparent on the chart, the pair has already exceeded the 8.2500 level.

Given that the exchange rate is supported by the 55-, 100– and 200-hour moving averages in the 7.8730/8.1600 area, it is likely that bulls could continue to prevail in the market in the medium run.

Meanwhile, note that the rate could face the resistance level formed by the monthly R1 at the 8.4645 mark. If the given resistance holds, it is likely that a reversal south could occur.

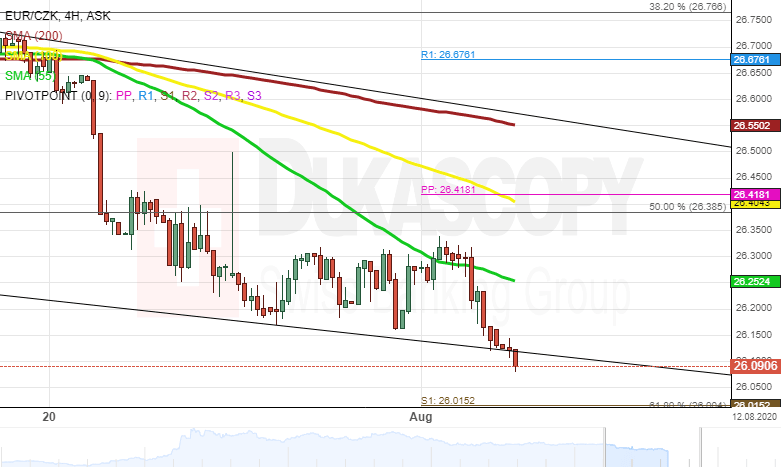

EUR/CZK 4H Chart: Falling wedge pattern in sight

The EUR/CZK exchange rate has been trading within a falling wedge pattern since the beginning of June. As apparent on the chart, the rate has pierced the lower pattern line.

If the given pattern holds, it is likely that the currency pair could continue to decline within it in the medium term.

In the meantime, note that the exchange rate is pressured by the 55-, 100– and 200-hour SMAs. Thus, it is likely that a breakout south from the pattern could occur, and the rate could decline below the 25.50 level.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.