Patterns: EUR/GBP, USD/CHF, EUR/TRY and EUR/CZK

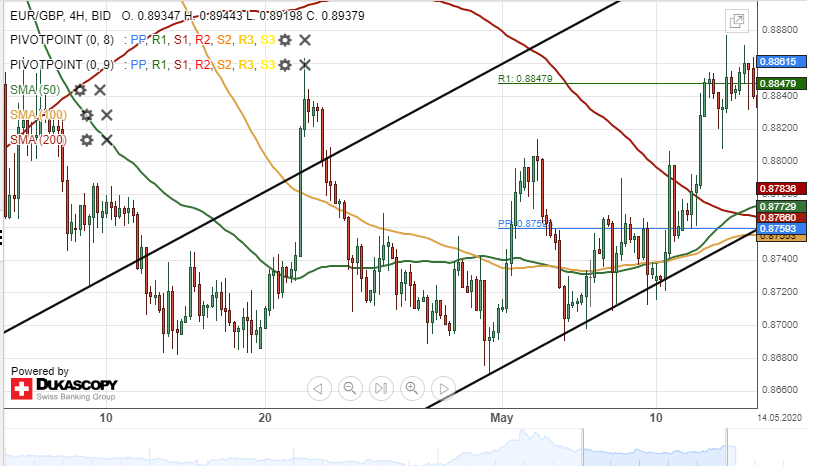

EUR/GBP 4h chart: Could edge lower

The common European currency has surged by 3.05% against the British Pound since the beginning of May. The currency pair tested the upper boundary of an ascending channel pattern at 0.8953 on May 18.

As for the near future, the EUR/GBP exchange rate will likely make a brief pullback towards a support cluster formed by the weekly PP and the monthly R1 at the 0.8860 area.

However, technical indicators suggest that the currency exchange rate could continue to trend bullish during the following trading sessions.

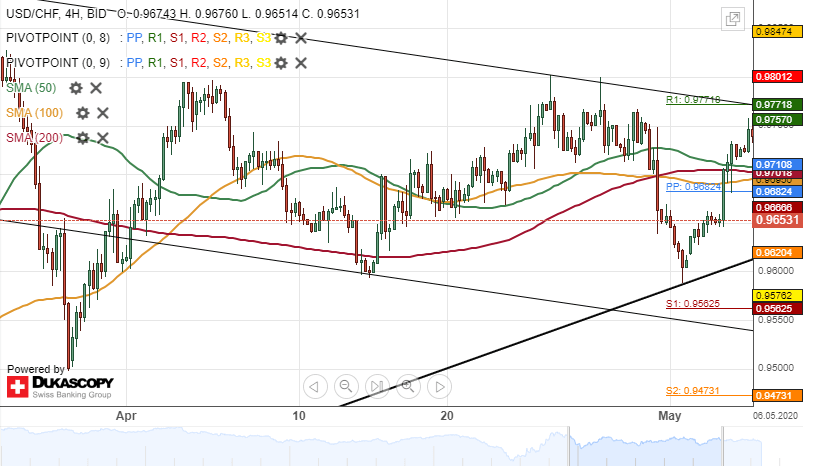

USD/CHF 4H chart: Two scenarios likely

The US Dollar has surged by 1.45% against the Swiss Franc since May 1. However, the USD/CHF currency pair has been trading sideways since this week's trading sessions.

Currently, the exchange rate is testing the lower boundary of a dominant ascending channel pattern at 0.9701.

If the dominant channel holds, a surge towards the weekly R2 at 0.9801 could be expected during the following trading sessions.

Though, if the currency exchange rate breaks the dominant ascending channel, bearish traders could aim for the weekly S2 at 0.9620 in the nearest future.

EUR/TRY 1H chart: Bears could prevail

As apparent on the chart, the EUR/TRY currency pair failed to surpass the psychological level at 7.8000. The pair has been trading downwards since the beginning of May.

Given that the exchange rate is pressured by the 55-, 100– and 200-hour moving averages, it is likely that some downside potential could prevail in the market. In this case the rate could gain support from the Fibo 38.20% at 7.0377.

It is unlikely that bulls could prevail in the market, and the currency pair could exceed the psychological level at 8.1000.

EUR/CZK 1H chart: Rising wedge pattern in sight

The EUR/CZK exchange rate has been trading within a rising wedge pattern since the middle of April.

From a theoretical point of view, it is likely that the currency pair could continue to trade upwards within the given pattern until the beginning of June. Then, a breakout south could follow.

Meanwhile, note that the exchange rate is pressured by the 55-, 100– and 200-hour SMAs. Thus, a breakout south could occur sooner. In this case the rate could gain support from the monthly S1 at 26.63.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.