Patterns: EUR/GBP, USD/CHF

EUR/GBP 4H Chart: Two scenarios likely

The common European currency has declined by 142 basis points or 1.65% in value against the British Pound since January 15. The decline began after the currency pair tested the upper boundary of a descending channel pattern at 0.8580.

The exchange rate is currently trading near a resistance cluster formed by the weekly and the monthly PPs at 0.8456.

If the resistance cluster holds, a decline towards a psychological level at 0.8300 could be expected.

However, if the EUR/GBP pair breaks the resistance cluster, bullish traders will drive the currency exchange rate towards the 0.8630 area during the following trading sessions.

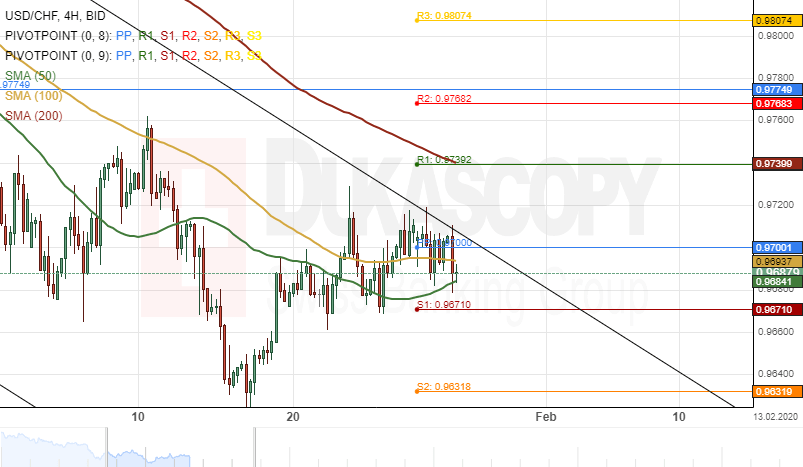

USD/CHF 4H Chart: Breakout could occur

The US Dollar has surged by 95 pips or 0.99% in value against the Swiss Franc since January 15. The currency pair tested the upper boundary of a descending channel pattern at 0.9712 on January 27.

Given that the USD/CHF exchange rate is trading near the upper boundary of the descending channel pattern, a breakout might occur within this week's sessions.

If this breakout occurs, a surge towards a resistance cluster formed by the weekly R2 and the monthly PP at 0.9774 could be expected.

However, if the descending channel holds, the currency exchange rate will most likely continue its downward movement in the shorter term.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.