Patterns: EUR/CHF, EUR/HUF

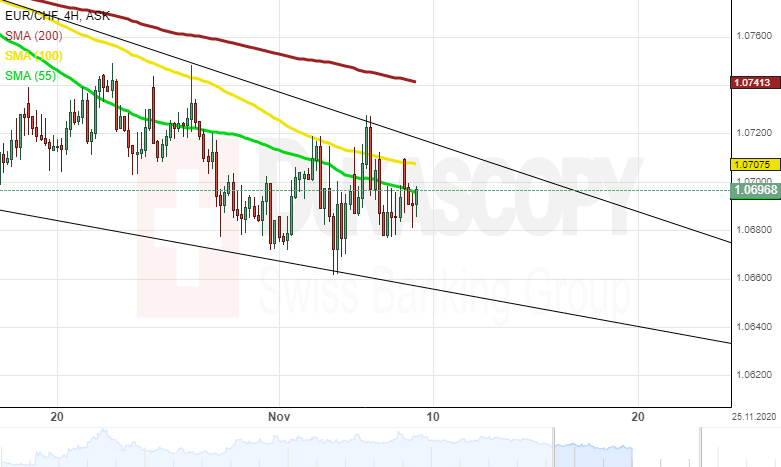

EUR/CHF 4H Chart: Two scenarios likely

The EUR/CHF currency pair continued to trade downwards within the falling wedge pattern.

From a theoretical point of view, it is likely that the exchange rate could decline within the given pattern within the following trading sessions. Then, a breakout north could occur, and the rate could target the Fibo 23.60% at 1.0861.

Meanwhile, note that the currency pair is pressured by the 55-, 100– and 200-period moving averages in the 1.0695/1.0740 range. Thus, some downside potential could continue to prevail in the market.

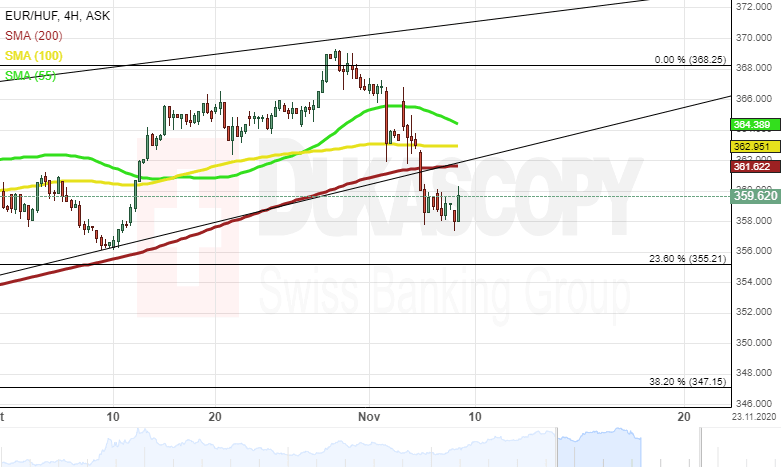

EUR/HUF 4H Chart: Bears could prevail

As apparent on the chart, the EUR/HUF exchange rate breached the rising wedge pattern south.

From a theoretical perspective, it is likely that some downside potential could prevail in the market. In this case the currency pair could target the Fibonacci 38.20% retracement at 347.15.

In the meantime, note that the pair could gain support from the Fibonacci 23.60% retracement at 355.21. Thus, a reversal north could occur, and the rate could re-test the 368.25 mark.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.