Patterns: EUR/CHF, AUD/CAD

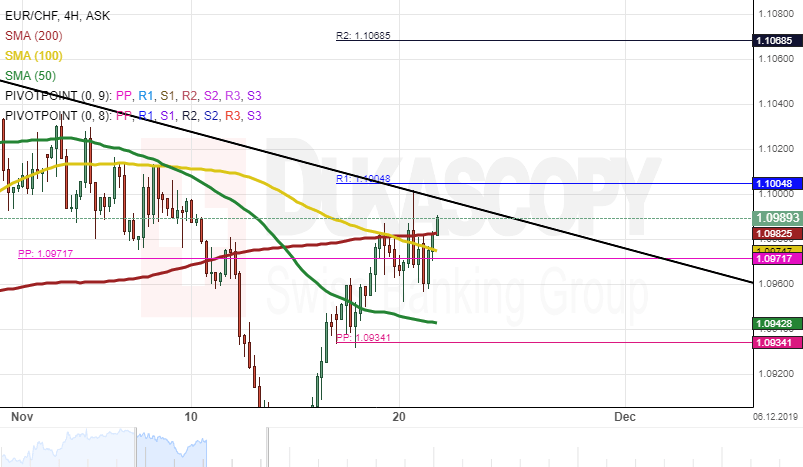

EUR/CHF 4H Chart: Buy signals

The common European currency has appreciated about 1.21% in value against the Swiss Franc since November 14. The currency pair tested the upper boundary of a descending channel pattern at 1.0997 during yesterday's trading session.

As for the near future, the EUR/CHF will likely edge lower in the shorter term. The potential target for bearish traders would be near a psychological level at the 1.0900 area.

However, a support cluster formed by the 50– period simple moving average and the weekly pivot point at 1.0934 could provide support for the currency exchange rate during the following trading sessions.

AUD/CAD 4H Chart: Could edge higher

The Australian Dollar has depreciated about 1.34% in value against the Canadian Dollar since November 7. The currency pair tested the lower boundary of an ascending channel pattern at 0.8972 on November 18.

Given that the exchange rate has bounced off the bottom border of the channel pattern, bullish traders are likely to continue to dominate the pair during the following trading sessions. The potential target will be at the weekly R2 at the 0.9126 area.

Furthermore, technical indicators demonstrate bullish signals on the daily time-frame chart.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.