Patterns: EUR/AUD, EUR/CAD, AUD/CHF, and CHF/SGD

EUR/AUD 4H Chart: Could continue to surge

The Eurozone single currency surged by 192 pips or 1.19% against the Australian Dollar last week. The currency pair breached the 50-, 100– and 200– period SMAs during last week's trading sessions.

As for the near future, the EUR/AUD exchange rate will most likely continue to edge higher. Bullish traders could target the weekly R2 at 1..6496 during the following trading sessions.

However, the weekly resistance line at 1.6415 could provide resistance for the currency exchange rate within this week's trading sessions.

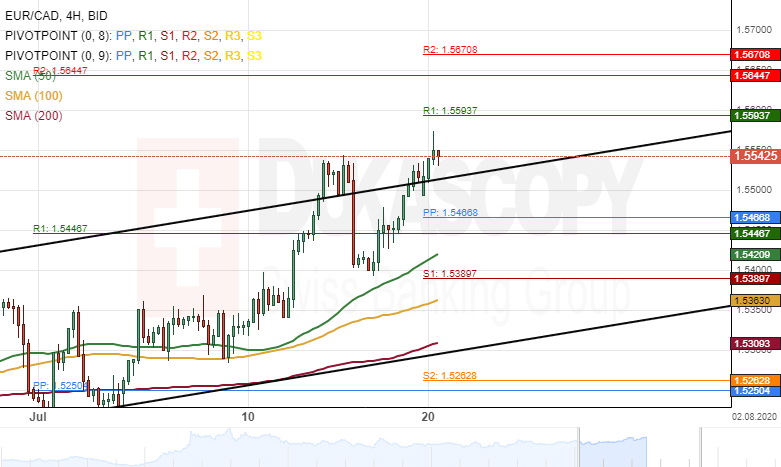

EUR/CAD 4H: Breakout occurs

The common European currency has surged by 330 pips or 2.17% against the Canadian Dollar since July 6. The currency pair breached the upper boundary of an ascending channel pattern at 1.5522 on Monday morning.

Given that a breakout had occurred, the EUR/CAD exchange rate could continue to surge. The exchange rate is likely to target the 1.5650 mark during the following trading sessions.

On the other hand, the currency exchange rate could reverse from the current price level at 1.5543 and aim for the 50– period SMA at 1.5416 within this week's trading sessions.

AUD/CHF 1H Chart: Ascending channel in sight

The AUD/CHF currency pair has been trading upwards within an ascending channel since the end of June.

From a theoretical point of view, it is likely that the exchange rate could continue to extend gains within the given channel in the medium term. In this case the rate could exceed the 0.6650 mark by the end of August.

Meanwhile, it is unlikely that bears could prevail in the market, and the currency pair could decline below the Fibonacci 38.20% retracement at 0.6433.

CHF/SGD 1H Chart: Twoscenarios likely

The CHF/SGD exchange rate has been declining within a descending channel since the middle of June.

From a theoretical perspective, it is likely that the currency pair could continue to trade downwards within the given channel in the medium term. In this case the pair could decline to the support level—the monthly PP at 1.4658.

Meanwhile, note that the exchange rate is supported by the 55-, 100– and 200-hour moving averages near 1.4780. Thus, a breakout north could occur, and the rate could target the 1.5100 level.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.