Patterns: EUR/AUD, EUR/CAD

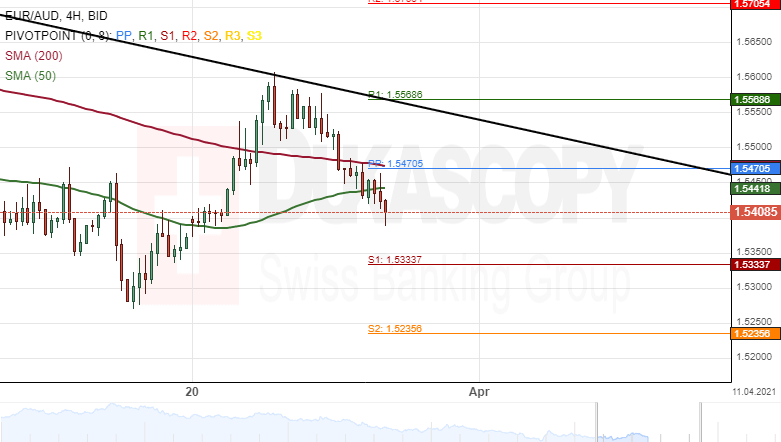

EUR/AUD 4H Chart: Bears could prevail

The common European currency declined by 1.00% against the Australian Dollar during last week's trading sessions. The currency pair reversed from the 1.5600 level on March 24.

All things being equal, the exchange rate could continue to edge lower during the following trading sessions. The potential target for the EUR/AUD pair will be near the 1.5300 area.

However, a support cluster at the 1.5350 level could provide support for the currency exchange rate in the shorter term.

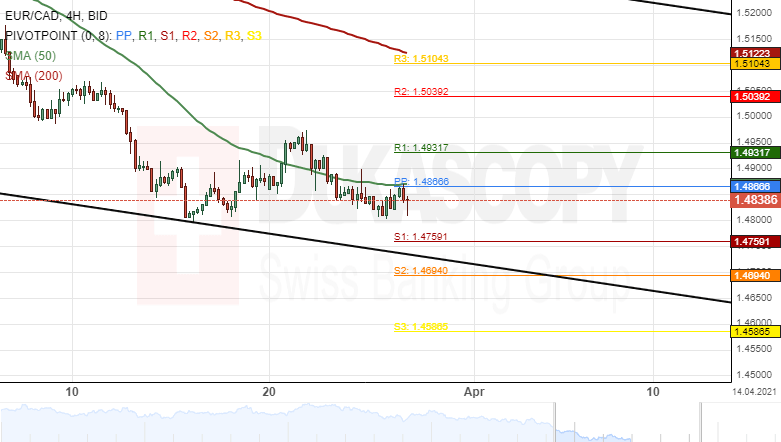

EUR/CAD 4H Chart: Decline likely to continue

The Eurozone single currency fell by 1.05% against the Canadian Dollar during last week's trading sessions. The EUR/CAD currency pair tested the 1.4800 level on March 26.

Everything being equal, the exchange rate could continue to edge lower. A breakout through the lower boundary of a descending channel pattern could occur this week.

However, the weekly support level at 1.4761 could provide support for the currency exchange rate in the shorter term.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.