Patterns: DOLLAR.IDX/USD, GBP.IDX/GBP

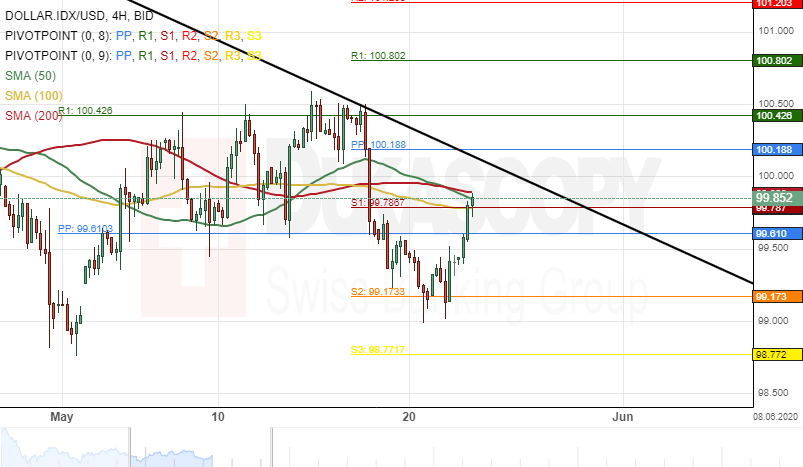

DOLLAR.IDX/USD 4H Chart: Decline likely to continue

The dollar index, which measures the US Dollar against a basket of major currencies, has declined by 141 basis points or 1.41% since May 14. The currency pair breached the 50-, 100– and 200– period SMAs during this week's trading sessions.

All things being equal, the Dollar.IDX/USD pair could continue to edge lower during next week's sessions. The potential target for bears would be near the 97.00 region.

However, the exchange rate could slide higher towards the 100.00 mark in the shorter term.

GBP.IDX/GBP 4H: Could continue to surge

The UK100, which measures the best 100 performing stocks from the UK LSE, has surged by 6.44% since last week's trading sessions. The index breached the 6007.5 on May 18.

Technical indicators suggest buying signals on both the smaller and the daily time-frame charts. Therefore, GBR.IDX/GBP pair will most likely continue to edge higher next week.

On the contrary, the weekly resistance level at 6187.3 could provide resistance for the UK index during the following trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.