Patterns: CHF/JPY, CAD/CHF

CHF/JPY 4H Chart: Slight upside potential likely

The Swiss Franc made a U-turn from a support level formed by the monthly S1 at 106.90 during last week's trading sessions. As a result, the currency pair has gained about 1.50% in value during this period.

The CHF/JPY exchange rate could aim for September 13 swing high at 109.50 within the following trading sessions. Moreover, the monthly pivot point and the combination of the 100– and 200– period SMAs are providing support for the pair at 108.24.

However, given that the currency exchange rate is currently trading in a downtrend line, bears could have the upper hand in the market within next week's sessions.

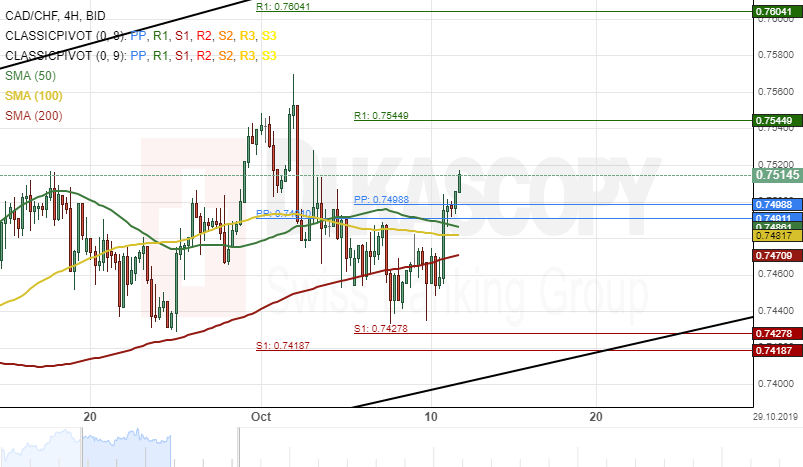

CAD/CHF 4H Chart: Bounces off support cluster

Since the beginning of October, the Canadian Dollar has been falling against the Swiss Franc. The currency pair has lost about 1.46% in value during this short period.

However, the CAD/CHF exchange rate bounced off a support cluster at the 0.7427 area during yesterday's trading session. Most likely, bulls could drive the price towards the 0.7560 marks in the shorter term.

The long-term target for the currency exchange rate would be at the upper boundary of an ascending channel pattern at 0.7615.

Although, bulls will have to surpass the weekly R1 at 0.7544 before reaching the given target.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.