Patterns: CAD/CHF, CHF/JPY

CAD/CHF 4H Chart: Likely to maintain channel

The Canadian Dollar has been depreciating in a descending channel pattern against the Swiss Franc since October 28. The currency pair surged by 109 basis points during last week's trading sessions.

The 200– hour simple moving average is currently providing resistance for the exchange rate at 0.7514.

All things being equal, the CAD/CHF pair will most likely continue to trade in the descending channel pattern during next week's trading sessions. The possible target will be at the 0.7400 zones.

However, given that the currency exchange rate is trading near the upper border of the channel pattern, a breakout could occur next week.

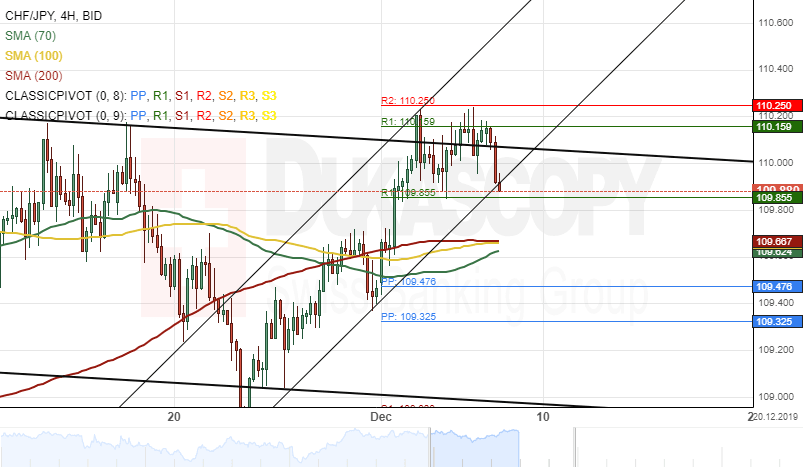

CHF/JPY 4H Chart: Trades in narrow channel

The Swiss Franc has been trading in a narrow ascending channel pattern against the Japanese Yen since the end of November. The currency pair has surged by 1.21% in value during this period.

Everything being equal, the CHF/JPY exchange rate will likely trade south within next week's trading sessions. Bearish traders could target the 50-, 100– and 200– period SMAs at 109.66.

However, technical indicators suggest that the currency exchange rate will continue to trade north during the following trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.