Patterns: CAD/CHF, CHF/JPY

CAD/CHF 4H Chart: Sets for breakout

The Canadian Dollar has depreciated about 1.80% in value against the Swiss Franc since last week's trading sessions. The currency pair tested the weekly S1 at 0.7434 on Thursday.

The CAD/CHF exchange rate is currently trading near the upper boundary of a descending channel pattern at 0.7480 and could be set for a breakout.

If the breakout occurs, a surge towards a psychological resistance level at 0.7550 could be expected during next week's trading sessions.

However, if the descending channel holds, the currency exchange rate will most likely maintain the channel pattern in the nearest future.

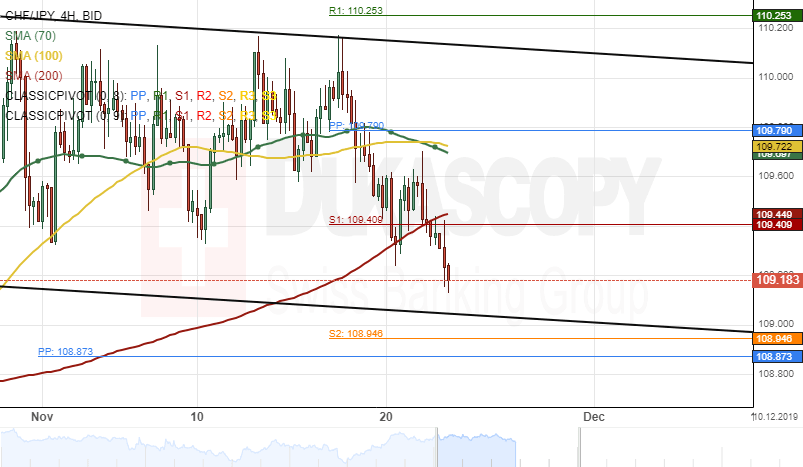

CHF/JPY 4H Chart: Moving towards 108.87

The Swiss Franc has depreciated about 0.75% in value against the Japanese Yen since this week's trading sessions. The currency pair breached the 200– period simple moving average at 109.43 on Friday morning.

All things being equal, the CHF/JPY currency exchange rate will likely aim for a support cluster formed by the combination of the weekly S2 and the monthly pivot point at the 108.87 area.

Most likely, an upside reversal could occur from the support cluster during next week's trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.