Patterns: BRENT.CMD/USD, LIGHT.CMD/USD, USD/ZAR, USD/PLN

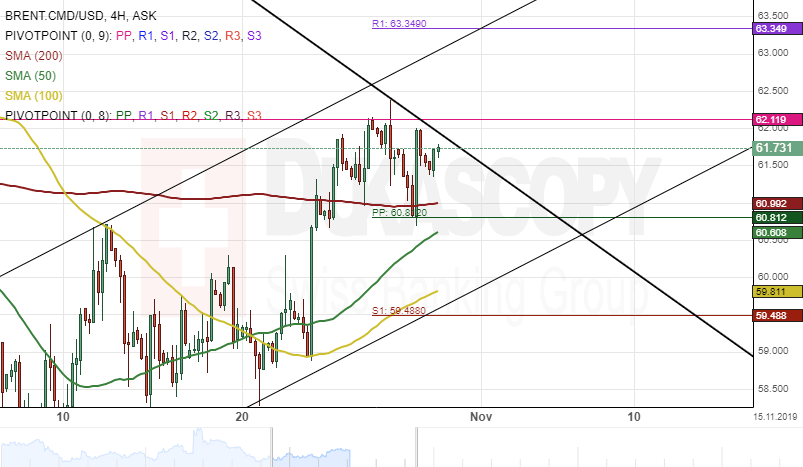

BRENT.CMD/USD 4H Chart: Likely to maintain channel

The Brent crude oil is currently trading in a narrow ascending channel pattern against the US Dollar. The commodity tested the monthly pivot point at 62.11 on October 28.

The BRENT.CMD/USD pair will most likely maintain the narrow ascending channel within the following trading sessions. The potential target for the exchange rate will be near the weekly R2 at 64.67.

If the weekly R2 holds, bears are likely to come into play and drive the benchmark price lower during the following trading sessions.

LIGHT.CMD/USD 4H Chart: Could edge higher

Light crude oil is gradually edging higher against the US Dollar. The commodity breached both the 50-, 100– and 200– hour simple moving averages during this period.

As for the near future, the light crude oil price will likely continue to surge in a narrow ascending channel pattern until it reaches a resistance level formed by the weekly R2 at 59.43.

If the resistance level holds, the LIGHT.CMD/USD pair could make a retracement towards a support level formed by the monthly pivot point at 56.84 could occur during the following trading sessions.

USD/ZAR 1H Chart: Descending triangle pattern in sight

The USD/ZAR currency pair has been trading downwards since the beginning of October when it reversed south from the upper boundary of the descending triangle pattern at 15.40.

Currently, the exchange rate is testing the lower pattern line at 14.52. From a theoretical point of view, it is likely that a reversal north could occur in the nearest future, and the rate could reach the upper pattern line at 15.30 in the medium term.

However, note that the currency pair is pressured by the 200-hour moving average. Thus, if the given pattern does not hold, some downside potential could prevail in the market. In this case, the pair could decline to the Fibonacci 38.20% retracement at 14.06.

USD/PLN 1H Chart: Two scenarios likely

The US Dollar has been depreciating against the Polish Zloty since the beginning of October. As apparent on the chart, the USD/PLN exchange rate is trading at the 3.8540 level.

Note that the currency pair is pressured by the 55– and 100-period moving averages (4H time-frame chart). Therefore, it is likely that some downside potential could prevail in the market. A possible downside target is the Fibonacci 38.20% retracement at 3.7496.

However, note that the exchange rate could gain support of the monthly S2 at 3.8488 and reverse north in the nearest future. In this case, the rate could target the monthly S1 located at the 3.9302 mark.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.