Patterns: AUD/JPY, GBP/JPY, USD/SGD, SGD/JPY

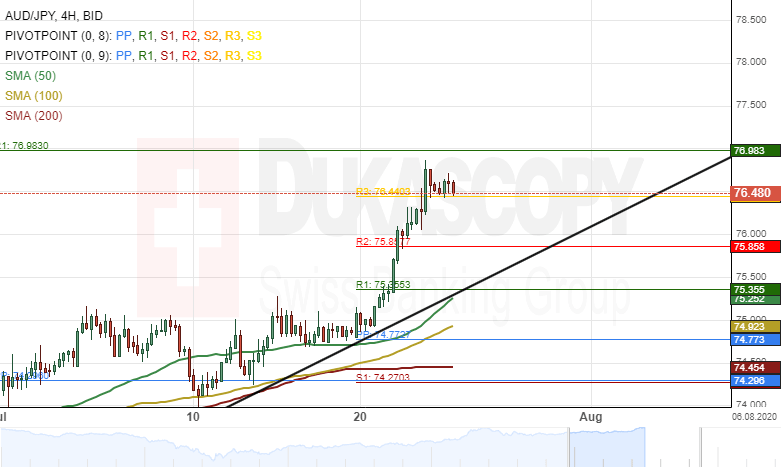

AUD/JPY 4H Chart: Could continue to trade bullish

The Australian Dollar has surged by 269 points or 3.63% against the Japanese Yen since the past two weeks. The currency pair hit a one-month high level at 76.63 during yesterday's trading session.

Technical indicators suggest buying signals on all time-frames. Most likely, bullish traders will continue to drive the exchange rate higher during the following trading sessions.

However, the monthly resistance level at 76.93 could provide resistance for the currency exchange rate in the short-term.

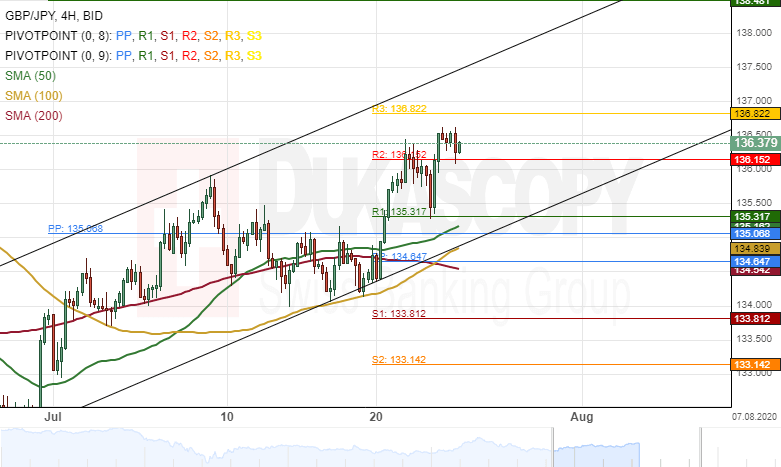

GBP/JPY 4H: Likely to maintain channel

The Pound Sterling has edged higher by 236 points or 1.76% against the Japanese Yen since last week's trading sessions. The currency pair breached the weekly R2 at 136.15 on July 23.

As for the near future, the exchange rate could continue to surge in an ascending channel pattern. The potential target for the GBP/JPY pair will be at the institutional level at 137.00.

However, the weekly resistance line at 136.82 could provide resistance for the currency exchange rate during the following trading sessions.

USD/SGD 1H Chart: Descending channel in sight

The USD/SGD currency pair has been trading within a descending channel since the end of June.

From a theoretical point of view, it is likely that some downside potential could prevail in the market, and the exchange rate could trade downwards within the given channel in the medium term. In this case the rate could gain support from the Fibo 50.00% at 1.3803.

Meanwhile, it is unlikely that bulls could prevail in the market, and the currency pair could exceed the Fibo 61.80% located at the 1.3977 mark.

SGD/JPY 1H Chart: Ascending triangle in sight

The SGD/JPY exchange rate has been trading within an ascending triangle pattern since the end of June.

From a theoretical point of view, it is likely that the currency pair could continue to trade sideways within the given pattern until the second half of August.

Meanwhile, note that the exchange rate is supported by the 55-, 100– and 200-hour moving averages in the 77.20 area. Thus, a breakout north could occur in the nearest future, and the rate could target the psychological level at 79.00.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.