Patterns: AUD/JPY, GBP/JPY

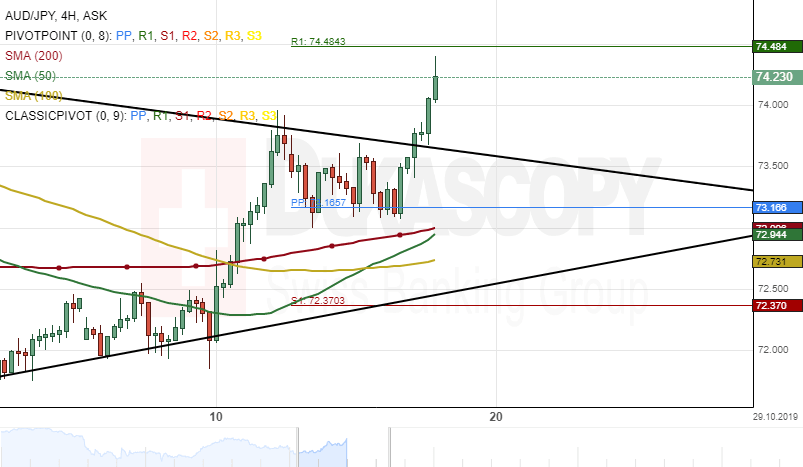

AUD/JPY 4H Chart: Upside potential

Upside risks have been dominating the Australian Dollar versus the Japanese Yen since the beginning of October. The currency pair appreciated about 2.74% in value during last week's trading sessions.

A breakout had occurred through the upper boundary of a descending channel pattern. From a technical aspect, the exchange rate will most likely continue its bullish momentum within the following trading sessions. The potential target will be at the 76.00 area.

Furthermore, technical indicators flash buy signals on the 4(H) and the daily time-frame charts.

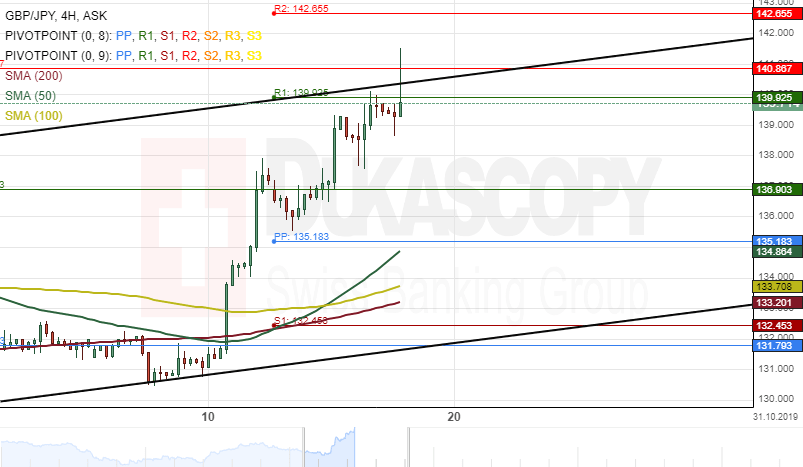

GBP/JPY 4H Chart: Two scenarios likely

Bullish impulse has dominated the British Pound against the Japanese Yen since last week's trading sessions. The currency pair has appreciated about 6.60% in value during this period.

As for the near future, the GBP/JPY exchange rate could make a brief retracement towards the 136.90 region, which was a previous resistance level, that will act as a new support line.

However, if the UK Prime Minister Boris Johnson secures the Brexit agreement, strong upside momentum could be expected within the following trading sessions.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.