OPEC times Biden perfectly with October production cut surprise

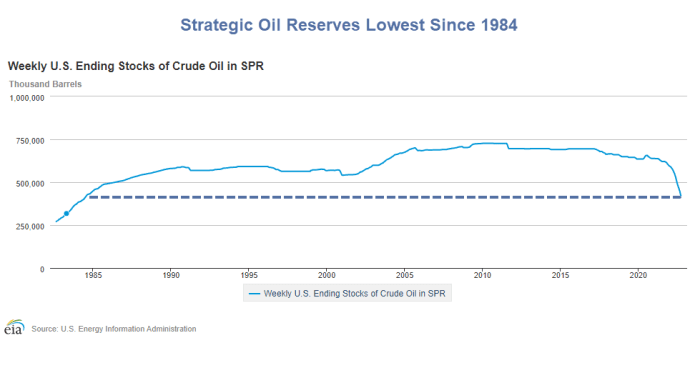

The US Strategic Petroleum Reserve SPR is down about 32 percent from a year ago and the lowest level since 1984.

Chart courtesy of US Energy Information Agency EIA

Please consider OPEC’s October Oil Surprise

A couple of months ago Mr. Biden sojourned to Saudi Arabia to beg the Crown Prince for help containing surging U.S. gasoline prices. Now it looks like the meeting was worse than unproductive. Reports say OPEC and its allies including Russia will consider slashing their production targets by a million barrels a day when they meet this week.

Analysts estimate this would lift crude prices to about $100 a barrel from the $80 to $90 range of the last month.

The Administration has released 200 million barrels or so from the Strategic Petroleum Reserve over the past year and about one million barrels a day in recent months. These drawdowns were scheduled to end this month, but the Administration recently extended the releases into November, no doubt worried that a taper would increase gasoline prices before the midterm election.

Producers normally respond to rising prices by raising output. That was true in the past in the U.S., especially from 2016 to 2019 when production increased by about three million barrels a day. But U.S. producers haven’t responded to higher prices during the Biden Presidency as much as those in other countries, including Russia, Canada and Norway.

Pioneer Natural Resources CEO Scott Sheffield last month estimated that U.S. oil production will likely grow by a mere half a million barrels a day this year and perhaps even less in 2023. So even though oil prices have been about 50% higher under Joe Biden than under Donald Trump, production growth is about 50% lower.

Democrats blame oil drillers for prioritizing profits over production, but companies must consider the long-term return on investment. The Biden policies have created substantial regulatory uncertainty, raised production costs, and directed capital to green energy.

Electioneering is not strategic

Biden has it in for oil companies begging both Saudi Arabia and Venezuela to increase production.

Noe the SPR supply is down to about 21 days. If there was a genuine emergency that's all we have.

There is nothing at all strategic about Biden's draw down unless you consider midterm election politics as strategic.

Will a weakening economy offset the expected cuts?

Meanwhile please note ISM Drops to Lowest Level Since May 2020, New Orders Plunge Into Contraction

The September ISM report is much weaker than expected, with employment, new orders, and new export orders all in contraction.

Good luck if there is even a mild shock with production cuts.

By the way, whatever happened to that Ridiculous Buyers' Cartel idea?

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc