Onto Fed's vaccination guidance

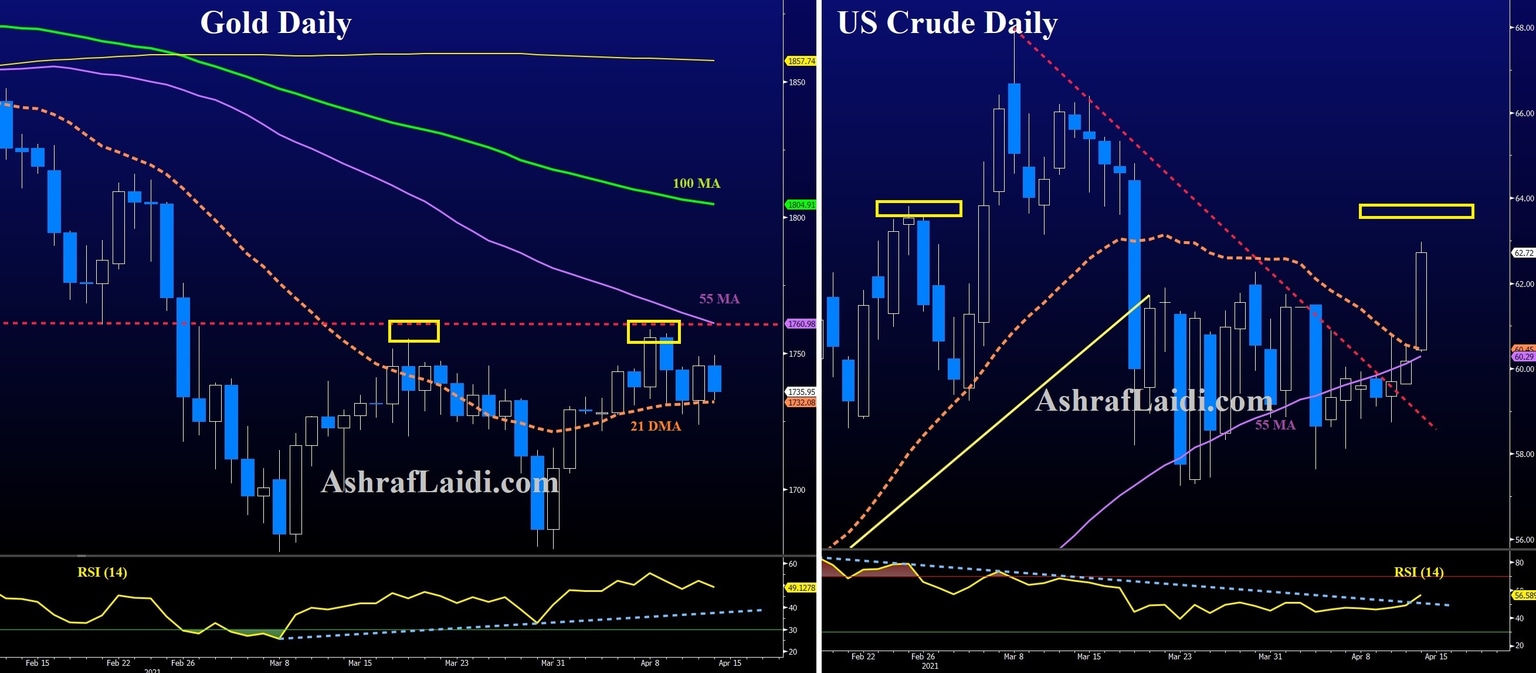

USD drops across the board following oil's 4% jump to 62.90s and markets' shrugging of a US CPI that was a touch higher than consensus. Today's Coinbase IPO coupled with Fed Chair Powell's appearance raises questions about the timing of the Fed's tapering (see more below). NZD and AUD are the strongest of the day, with XAU and CHF the only decliners vs USD. Powell is next.

Looking ahead, Fed Chair Powell speaks at 1600 GMT (1700 London, 1800 Dubai). In an notable comment on Monday, the Fed's Bullard said he would leave it up to Powell to start the conversation on tapering. But Bullard also raised the idea that a 75% vaccination rate in the USA may signal a clear end to Covid-19 and allow the Fed to consider tapering. At times, other FOMC members float ideas and Powell confirms them (like Brainard's comments on higher rates last month) but in this case it appears the strategy is to leave it to Powell. For now, it's premature for him to tee-up a taper but some time in the summer he will have to wade in.

Looking back at Tuesday's CPI report, it revealed just how concerned markets are about inflation. It rose 2.6% y/y compared to 2.5% expected with core and m/m readings also one-tenth above consensus. Markets were clearly fearing worse and the market reaction highlights the focus on inflation. The knee-jerk trade as higher in the US dollar but very quickly afterwards that reversed and continued in that direction throughout the day.

The takeaway is that the market breathed a sigh of relief that it wasn't a blowout like the PPI report last week.

Yields began to slide after the report as well, something that was compounded by a 1.8 bps stop through in the 30-year Treasury auction. Tally it all up and yield fell 4-5 bps on the day and US equities hit fresh records.

In FX, the slump in the dollar and growing optimism about the European vaccine rollout (despite the latest J&J setback) boosted EUR/USD to the highest since March 18. USD/JPY is also flirting with the April low and cable is trying to form a double bottom.

Author

Adam Button

AshrafLaidi.com

Adam Button has been a currency analyst at Intermarket Strategy since 2012. He is also the CEO and a currency analyst at ForexLive.