Oil price surges to multi-month high on demand optimism, increased output

WTI oil price surged above $76 per barrel on Thursday, hitting the highest since October 2018, supported by growing prospects of strengthening global demand, falling US inventories and OPEC+ decision to start gradually adding about 2 million barrels per day to the market in August – December period.

Cartel’s decision to start easing output curbs comes from tightening oil market amid acceleration of global economic recovery that boosted demand and oil prices.

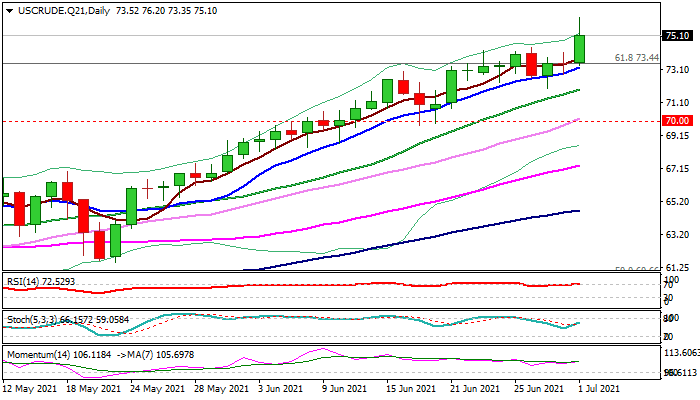

The WTI contract broke above psychological $70 barrier and registered a monthly advance of 6% in June (the biggest monthly rally since May 2020).

Bulls also generated strong positive signal on weekly close above pivotal Fibo barrier at $73.44 (61.8% retracement of larger $114.80/$6.52 fall) that shifts near-term focus towards Oct 2018 peak ($76.88), violation of which would open way for further advance and expose $80 target.

Corrective dips are expected to offer better buying opportunities.

Res: 75.83; 76.20; 77.00; 77.81

Sup: 74.42; 73.72; 73.44; 71.96

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.