Oil falls on stalling recovery

The largest oil consumers are both the United States and European Union – making up around 34% of the worldwide 100 Million demand (before the Coronavirus). Both Countries / Continents have seen daily increases in their Coronavirus case count. The United States currently has 7.1m Coronavirus cases, while Europe has around 5 million cases. Coincidentally (or not) – this makes up 36% of the total global Coronavirus cases. In other words, the future of the price of oil is heavily influenced by how these two nations handle the Coronavirus. Europe has to deal with individual countries governed by different styles of government to manage the Coronavirus. The United States, unfortunately, has all but given up.

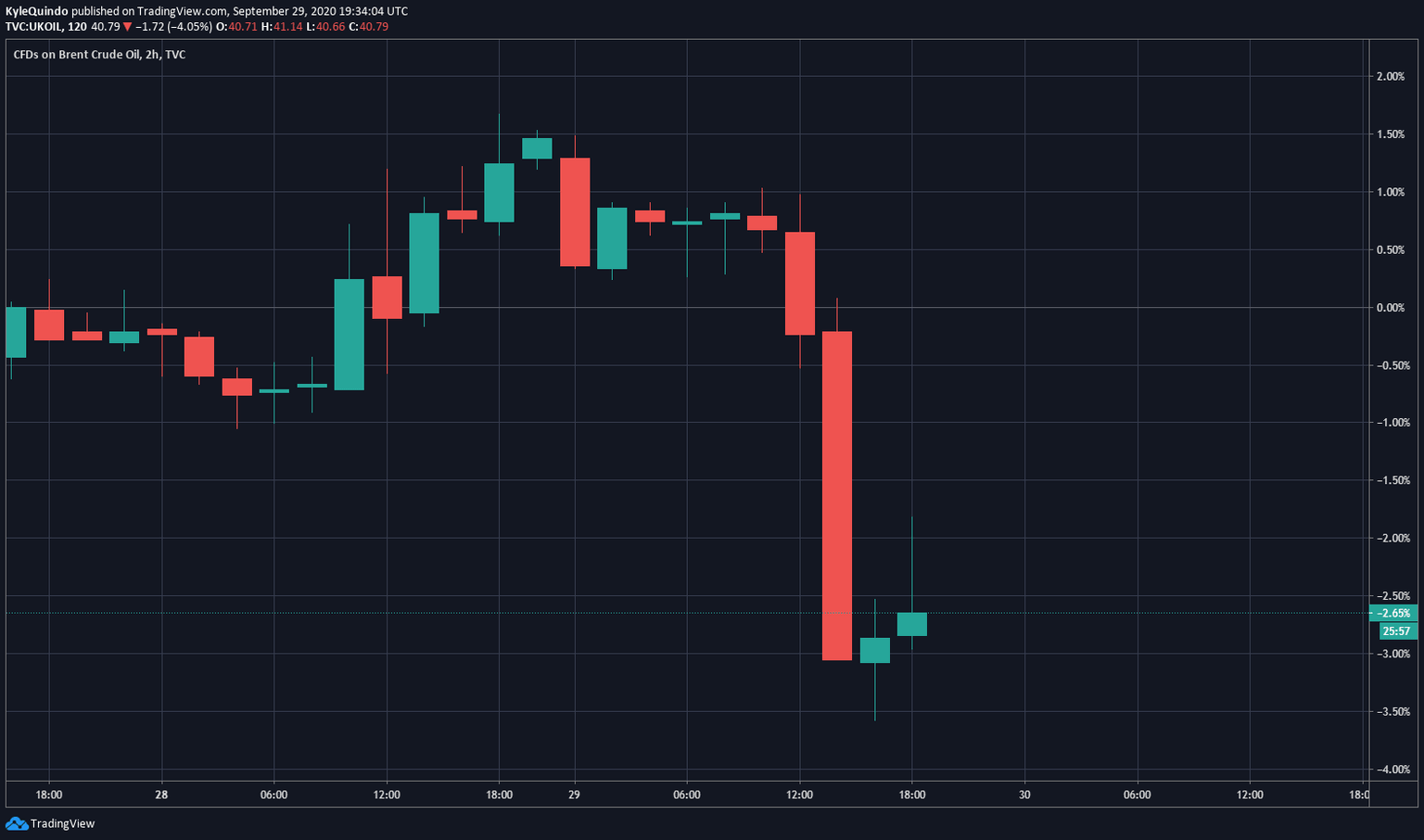

Brent Crude fell as much as 4% as Global risk-on sentiment softens. A resurgence in Coronavirus cases in Europe, alongside a constant double-digit reporting of new cases in the United States, pushed oil down. Oil’s struggle to rally comes from weak global fundamentals; therefore, it is quite susceptible to pullbacks. Brent has been trading in a tight range from $40 – $45 a barrel for the past couple of months.

Brent Crude drops 4%

Oil countries struggling

Low oil prices have forced many oil-producing countries to draw into their pockets to continue supporting their country. Most notably, with the lowest production cost of any oil producer at $2.80 per barrel, Saudi Arabia requires oil prices to be at $76 a barrel to achieve a fiscal break even. This has forced Saudi Arabia to triple its value-added tax, cut spending, and suspend the living allowance cost.

Oil trading houses going green

However, the long-term oil trend may not be as bright as OPEC+ may want it to be. Oil trading houses such as Mercuria, Vitol, Trafigura, and Gunvor are investing billions of dollars into renewable energy projects in the coming five years. Marco Dunand, Chief Executive of Mercuria, told the Financial Times that “If you want to exist in 10 years’ time and don’t want to be in renewables then I think it’s going to be tough” and that “Ove the next five years we should have about 50% of our investments into renewables”. However, oil giant BP predicts that developing countries will continue driving oil growth over the next ten years.

Author

Kyle Quindo

Blackbull Markets Limited

Kyle is a Research Analyst with BlackBull Markets in New Zealand. He writes articles on topical events and financial news, with a particular interest in commodities and long term investing.