Oil consolidates as Trump floats mixed signals

Crude oil prices have experienced their most volatile sessions since 2022, driven by the military conflict in the Middle East. Both WTI and Brent futures spiked by approximately 17% before erasing all gains after US President Donald Trump announced that a ceasefire agreement had been reached between Iran and Israel. However, in a surprise move, Trump later appeared to shift his stance, posting on social media that he may ease sanctions on Iran, potentially allowing China to purchase oil from the country.

While the president’s comments added confusion to the energy markets, crude prices have since stabilised, consolidating around current levels with little change. Thursday’s US crude inventory data showed stockpiles fell more than expected, as refining activity and demand increased, according to the EIA. The data provided some support to prices. Trump’s apparent pivot on Iran suggests he may be attempting to avoid high oil prices, which could drive inflation higher.

In general, the muted price movement suggests oil traders are now awaiting clearer signals from the US regarding the direction of nuclear negotiations. With geopolitical tensions temporarily easing, economic fundamentals—namely supply and demand—have once again become the primary driver of the oil market.

Several key economic events and data releases will be in focus in the coming days. First, next week’s US non-farm payroll report will be critical for global markets. Strong employment data could support oil prices on expectations of improved demand. Secondly, eight OPEC members are set to meet on 6 July to discuss joint production levels for August. The group, which accounts for around 40% of global oil supply, has cut output by 2.2 million barrels per day since 2023. It began unwinding these cuts in April, with a total increase of nearly 1.4 million barrels per day so far. Any acceleration in production hikes could weigh on oil prices.

Thirdly, the 90-day pause on Trump’s reciprocal tariffs is set to expire on 9 July. A return to the originally planned US import levies would likely dampen the global economic outlook and exert further pressure on crude prices. However, such a move currently appears unlikely.

Looking ahead, I expect oil prices to rebound from current levels, supported by a de-escalation of the global trade war, the potential passage of Trump’s “Big, Beautiful Bill,” and continued stimulus measures in China.

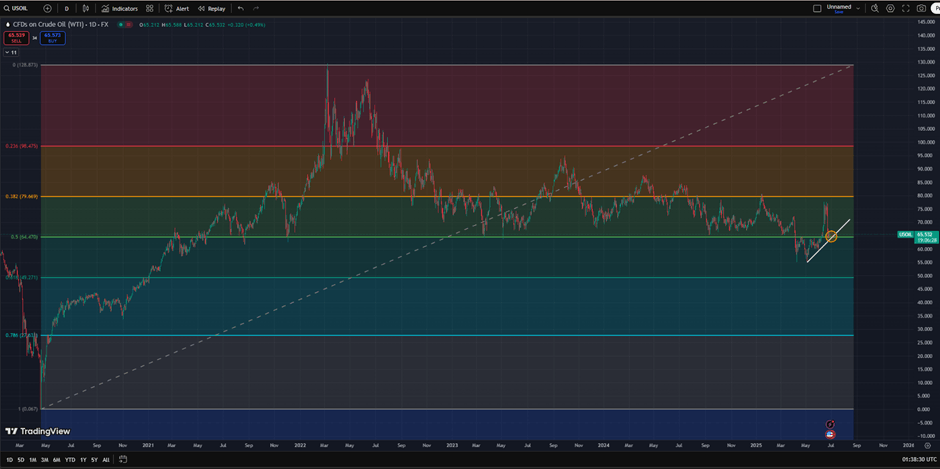

WTI – Cash, daily

Source: TradingView as of 27 Jun 2025

WTI crude has found support at the 50.0% Fibonacci retracement level, around $65 per barrel. At this price point, the risk–reward ratio is skewed to the upside, as it is testing a key demand zone typically associated with increased buying interest. A rebound from this level is likely, with a potential upside target near the 38.2% Fibonacci level, around $80 per barrel.

Conversely, a decisive break below the current support could open the way for a further decline, with the next key support at the previous low near $55 per barrel.

Author

Tina Teng

Independent Analyst

Tina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals.