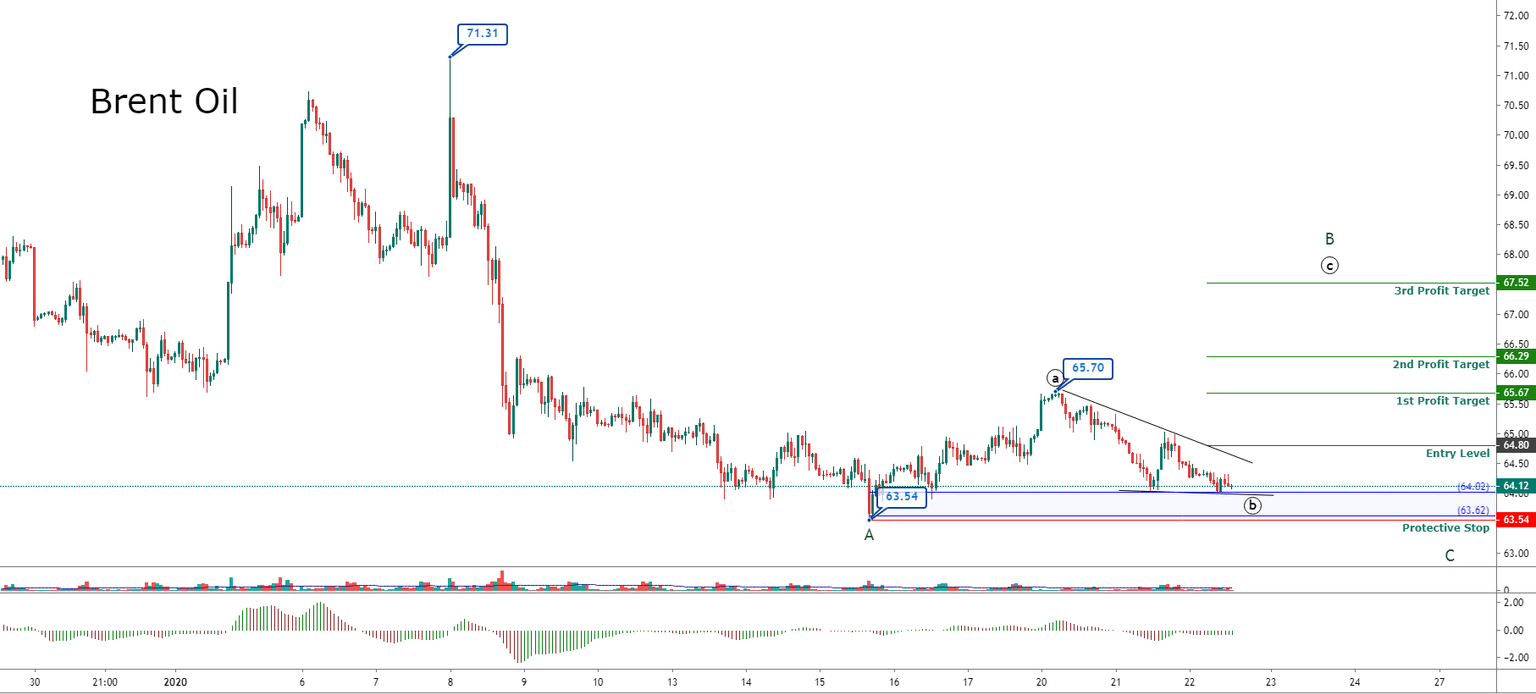

Oil Brent - An Elliott Wave Sequence Expects an Upward Reaction

Brent Oil, in its hourly chart, presents a corrective sequence in progress, which could react bullishly soon. The corrective formation started on January 08th, when the price found sellers at $71.31 per barrel. This first leg, identified as wave A of Minor degree labeled in green, completed its decline on January 15th at $63.54 per barrel. The current movement corresponds to a wave B. According to the Elliott wave theory, in a corrective formation, this movement must have three internal segments.

The Brent Oil chart reveals that the price action runs in a wave b of Minute degree labeled in black. The current internal path could react upward in the area between $64.02 and $63.62, from where the price could develop the wave c of Minute degree.

A long position will trigger if the price breaks and closes above $64.80 per barrel. Our conservative scenario foresees a potential first target at $65.67 per barrel.

The bullish progress could drive to the price to reach $66.28 and extend until $67.52 per barrel.

The invalidation level of our bullish setup is at $63.54 per barrel.

Trading Plan Summary

-

Entry Level: $64.80.

-

Protective Stop: $63.54.

-

1st Profit Target: $65.67.

-

2nd Profit Target: $66.29.

-

3rd Profit Target: $67.52.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and