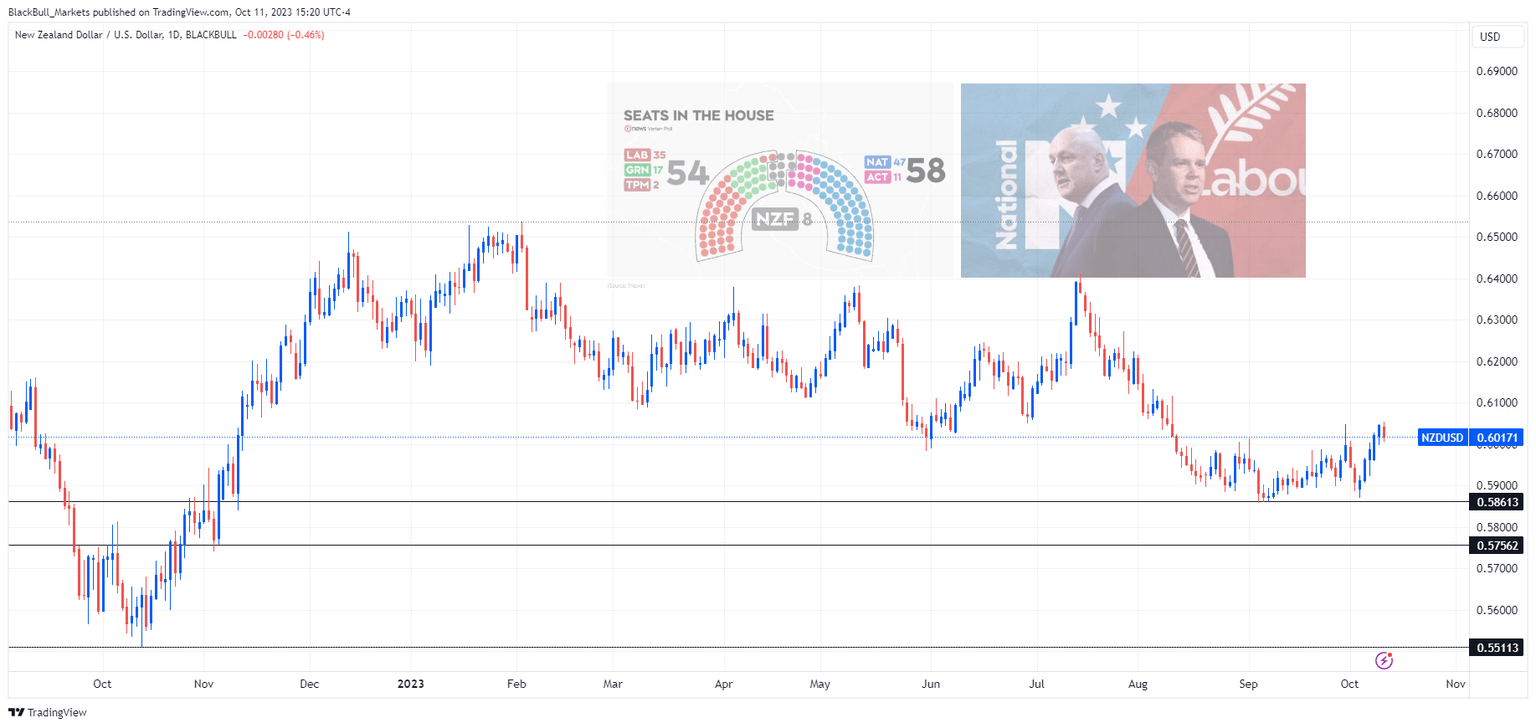

NZD/USD targets for election night

Fancy selling into uncertainty? This could be a scenario for the NZD/USD in the lead up to the election in New Zealand which is way too close to call for either major political party right now (Labour vs National). Voting has been open all week and closes October 14, with the winner called the same day (but after the close of this trading week).

Polls have the right leaning National party carving out a small lead at the moment, but some hiccups have seen this lead shrink in the past week (e.g., The were caught knowingly lying about amount the average person would receive from their promised tax cuts)

National has also promised to remove the Reserve Bank of New Zealand´s mandate to consider employment in its interest rate decisions, which could shift the central bank to a more dovish bias (as current strong employment figures in NZ are perhaps heightening its proclivity to hike). Combine this with the general uncertainty induced by the election, and some downside targets for the NZD/USD could be charted in anticipation for election night and the Monday following the results.

The recent touch point for the 0.5861 is the most obvious target that the pair will have to overcome if it wants to seek lower targets. This would also open up new 2023 lows, with 2022 benchmarks helping set possible targets.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.