NZD/CAD bears pierced 19-month low [Video]

![NZD/CAD bears pierced 19-month low [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/NZDUSD/new-zealand-money-nzd-dollars-amp-coins-50479594_XtraLarge.jpg)

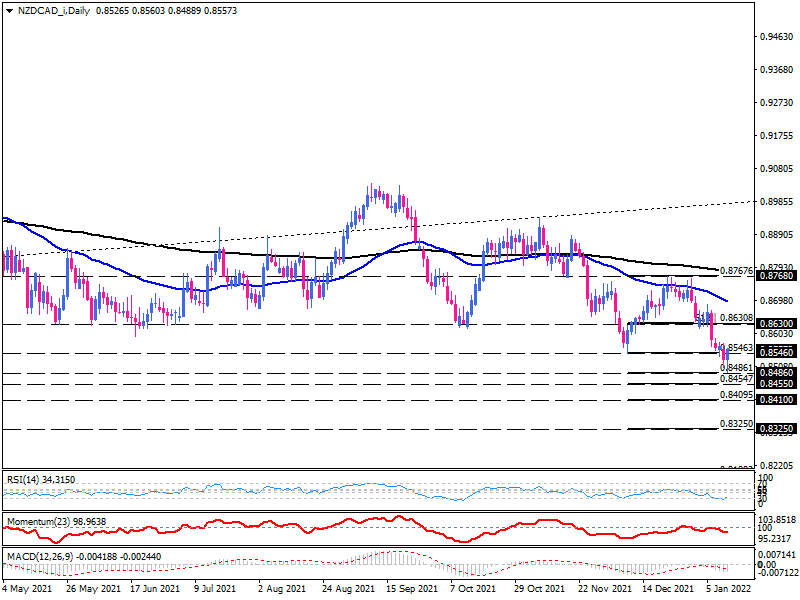

Since September 2021, NZD/CAD has been in a downward trend, forming lower tops and lower bottoms. A significant break through of the 0.8546 support level in Tuesday trading sent the price down to a 19-month low of around 0.8486.

As soon as the initial downside move steps over this barricade, the 0.8454-handle is expected to be claimed. If the development of selling forces continues to grow in the future, sellers might aim to clear the 0.8410 hurdle. By passing this obstacle, the further decline can lead to hitting the 0.8325 and 0.8188 resistance levels, respectively.

A bearish scenario is supported by the momentum oscillators. However, the RSI reading in the oversold territory indicates that it is likely that sellers will take a break in a very short period of time. At the same time, momentum is pointing lower below its 100-threshold, and the MACD is dipping into negative territory below its signal line.

Alternatively, if buyers are able to regain all the lost ground above the 0.8546-critical level, the price is likely to find immediate resistance at 0.8630 before proceeding to the 50-day exponential moving average. However, the downtrend remains in place as long as prices remain below the December high of 0.8767.

Author

Ali Mortazavi

Errante

BEc, CMSA, Member of IFTA - International Federation of Technical Analysis, Associate Member of STA - Society of Technical Analysis (UK).