Natural Gas: How high can prices go as January turns frigid?

As the United States braces for an icy January, natural gas prices are surging, driven by forecasts of colder-than-average temperatures that could stretch from Florida to Maine and the Great Lakes region. On Monday, February futures climbed by 15%, peaking at $4.201 per thousand cubic feet-a 52-week high and the commodity's highest level since early 2023. With winter’s chill tightening its grip, traders and analysts are asking: How high can prices go?

Colder-than-expected weather shakes markets

The latest updates from The Weather Co. and Atmospheric G2 forecast a significant cold snap across the Eastern United States, with the chill expected to peak mid-month. Snow and ice storms are anticipated during the first half of January, further amplifying energy demand for heating. This marks a dramatic shift from the mild conditions seen earlier this winter, catching both consumers and markets off guard.

Meanwhile, the Western U.S. is forecast to remain mild, with the Four Corners region experiencing the most above-average warmth. This regional temperature divergence underscores the complexities of predicting natural gas supply and demand.

Supply-side pressure mounts as the market reacts

As temperatures drop, concerns are growing about potential disruptions to natural gas production. Freeze-offs, where extreme cold halts the flow of natural gas at wellheads, are a particular risk in Appalachia’s Marcellus Shale, a key production area. “Bone-chilling polar vortex weather” could exacerbate these supply constraints, according to John Kilduff, founding partner of Again Capital.

In addition to weather-related risks, demand for liquefied natural gas (LNG) exports remains high. Gulf Coast facilities, including expansions at Cheniere Energy’s Corpus Christi plant and Venture Global LNG’s Plaquemines LNG facility, are ramping up production, further tightening domestic supplies.

The combination of frigid forecasts and supply risks has ignited a buying frenzy among traders. February futures surged as much as 20% earlier in Monday’s session before settling at a 15% gain. Year-to-date, natural gas prices are up 58%, including a 9% increase in just the past week.

This bullish sentiment is driven by the anticipation of heightened demand for heating and power generation, alongside fears of constrained production. Algorithmic trading funds have also shifted from flat to net long positions, reflecting growing confidence in continued price increases.

AccuWeather’s forecasts of a “stormy pattern” in the Eastern U.S. add another layer of complexity. Snow and ice storms could significantly disrupt transportation and infrastructure, further fueling demand for natural gas as a heating source during January’s first half.

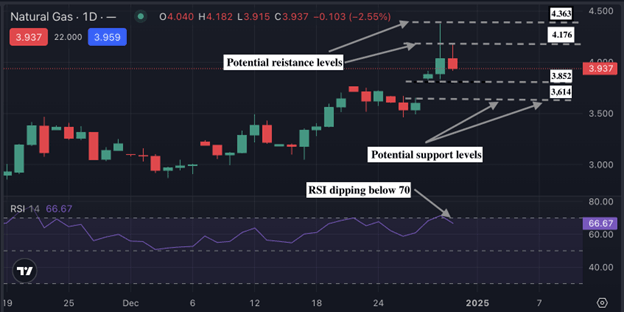

Technical outlook: How high can prices go?

The trajectory of natural gas prices hinges on several factors. If the cold spell persists into late January, production challenges and elevated demand could push prices even higher. However, a moderation in temperatures or an unexpected increase in production could temper the rally.

With weather patterns still uncertain for the latter half of the month, the market remains on edge. What’s clear is that the frigid conditions sweeping across the Eastern U.S. are reshaping the natural gas landscape, setting the stage for potentially record-breaking prices.

At the time of writing, prices are hovering around the $3.940 price level with buy pressure seemingly fading as RSI drops below 70. Upward pressure could struggle to breach the $4.176 and $4.363 resistance levels. On the downside, a price slump could find support at the $3.852 and $3.614.

Source: Deriv MT5

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.