My Jackson Hole plan

S&P 500 sucked in fresh ATH buyers, and then the rug pull came taking ES not just to my 5,615 support, but all the way to 5,585 one. Intraday clients profited on both sides yesterday, and in futures and options alike – I didn‘t trust the 5,638 intraday level to hold. How best to secure fresh liquidity today? SPY price recovery and a shakedown attempt, or just some FOMO?

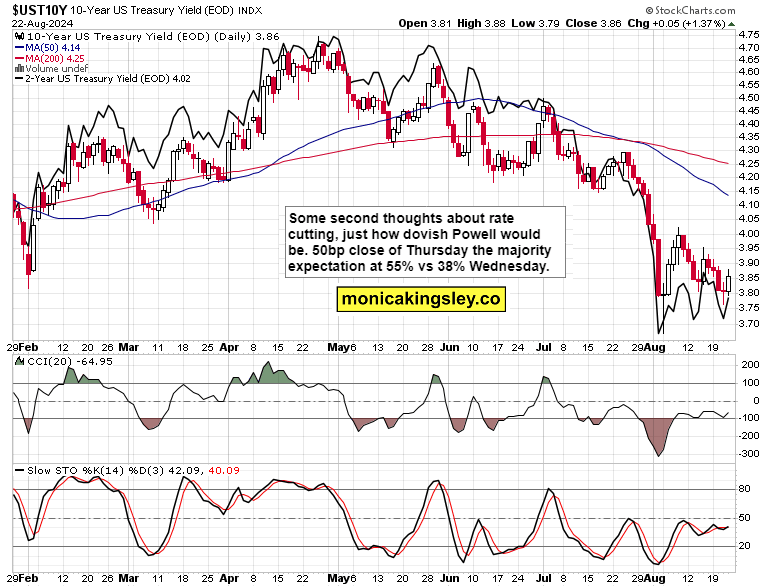

We saw some nice action in the Russell 2000 bucking the retreating rate cut odds, which were the real macroeconomic driver of yesterday‘s rejection of the elevator up ride off the „BoJ mea culpa“ dust having settled – and paradoxically adding fresh fuel to the rally in the days gone by.

What‘s notable, is the precious metals price action, and I released early in the week‘s premium prediction for how gold and silver would fare. Needless to say, fresh calls have been already made to clients over their premium Telegram, and that concerns oil as well, flirting with the $72 - $73 zone for a day more.

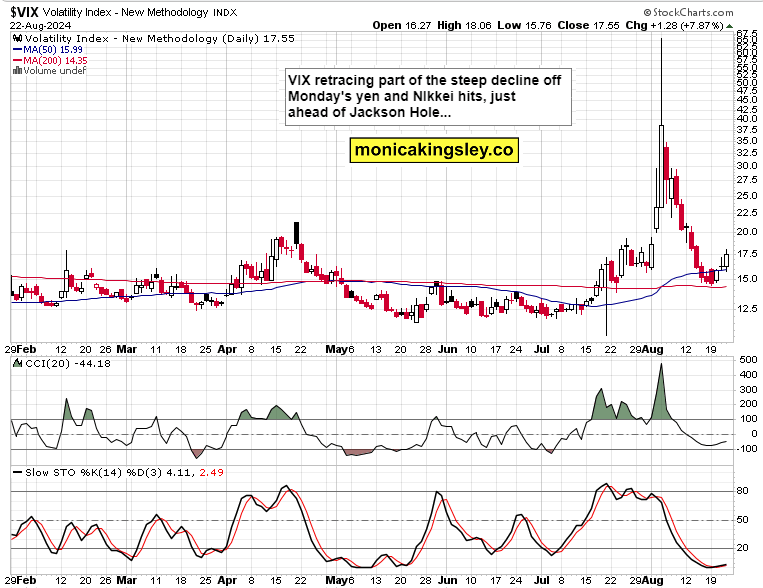

Here is what yesterday‘s S&P 500 session did to VIX and yields, and further calls are featured for clients.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.