Murrey math lines: USD/CHF, XAU/USD

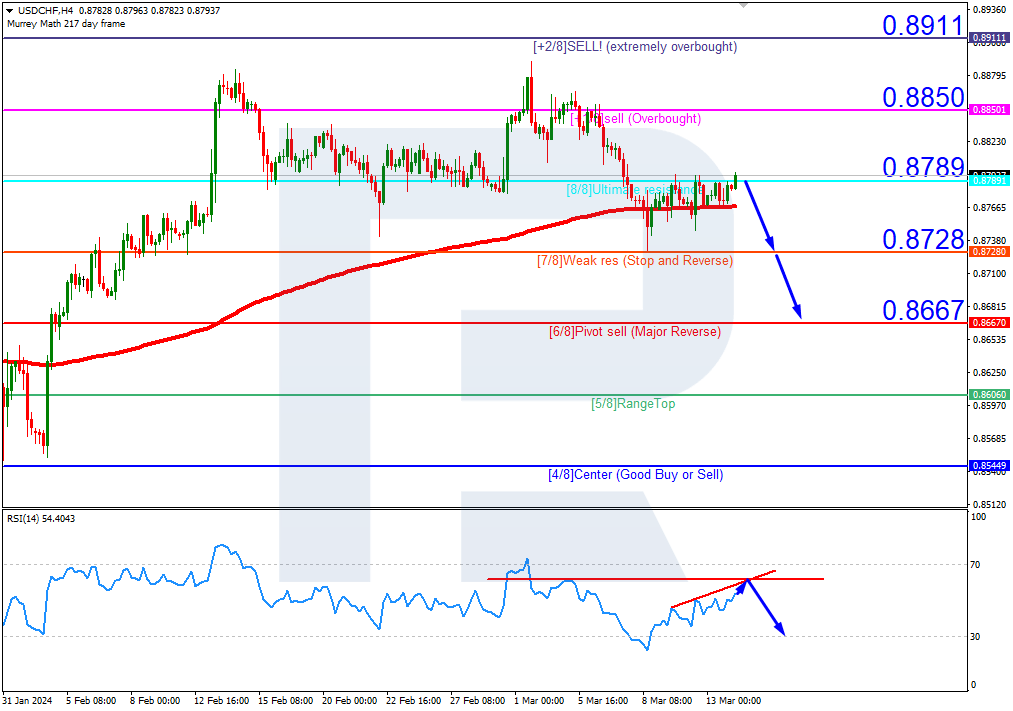

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF quotes are in the overbought area on H4, while the RSI is nearing the resistance line. In this situation, a breakout of the 8/8 (0.8789) level is expected, followed by a decline to the support at 6/8 (0.8667). The scenario could be cancelled by a breakout of the resistance at +1/8 (0.8850), in which case the pair might rise to the +2/8 (0.8911) level.

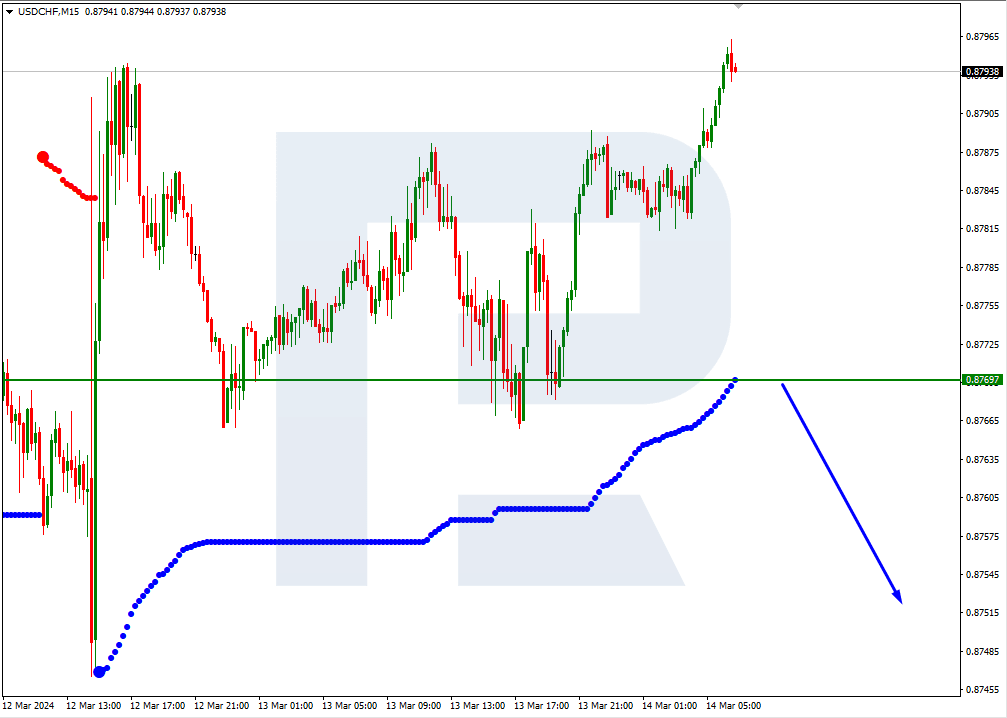

On M15, the price decline could be additionally confirmed by a breakout of the lower boundary of the VoltyChannel.

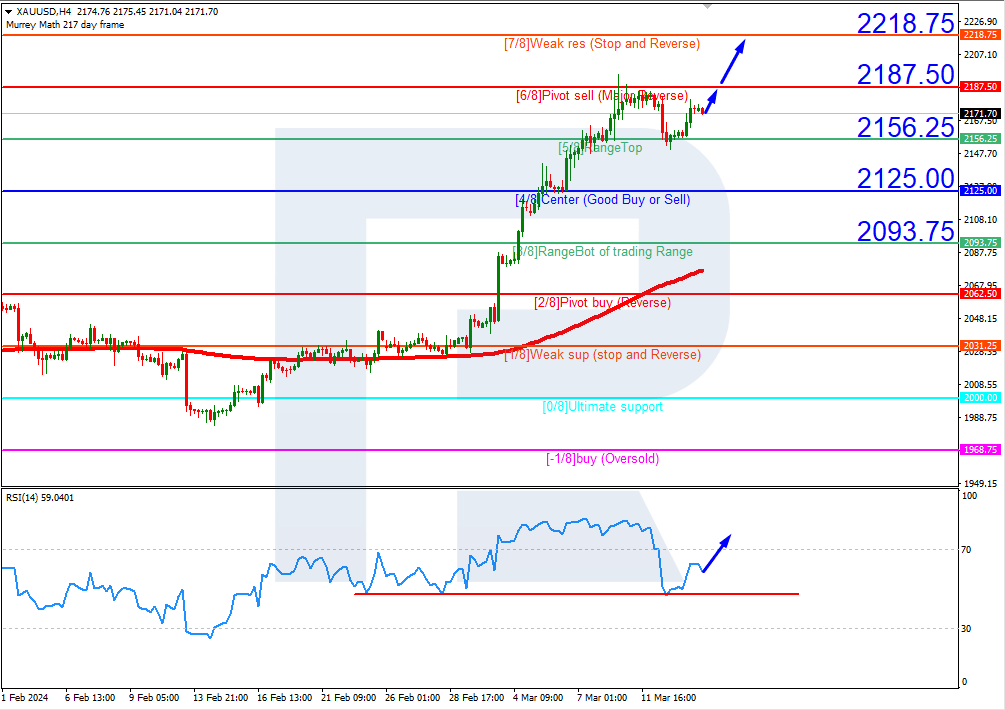

XAU/USD, “Gold vs US Dollar”

Gold quotes are above the 200-day Moving Average on H4, which indicates the prevalence of an uptrend. The RSI has rebounded from the support line. In these circumstances, the quotes are expected to break the 6/8 (2187.50) level, rising to the resistance at 7/8 (2218.75). The scenario could be cancelled by a breakout of 5/8 (2156.25), in which case gold quotes might drop to the support at 3/8 (2093.75).

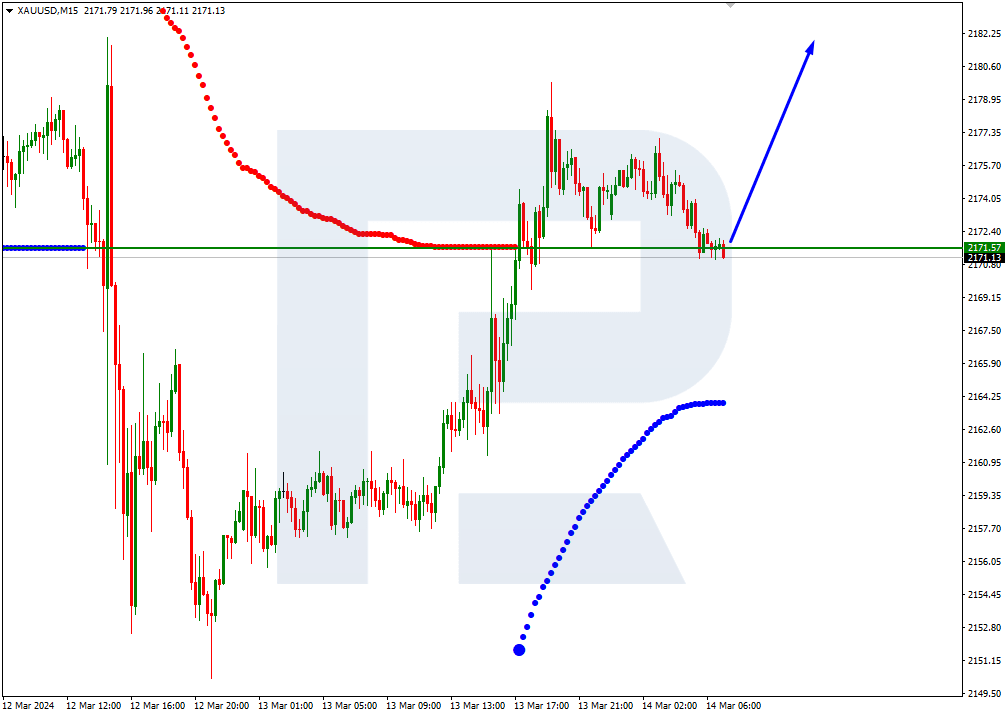

On M15, another breakout of the upper boundary of the VoltyChannel might increase the probability of price growth.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.