Murrey math lines: EUR/USD, GBP/USD

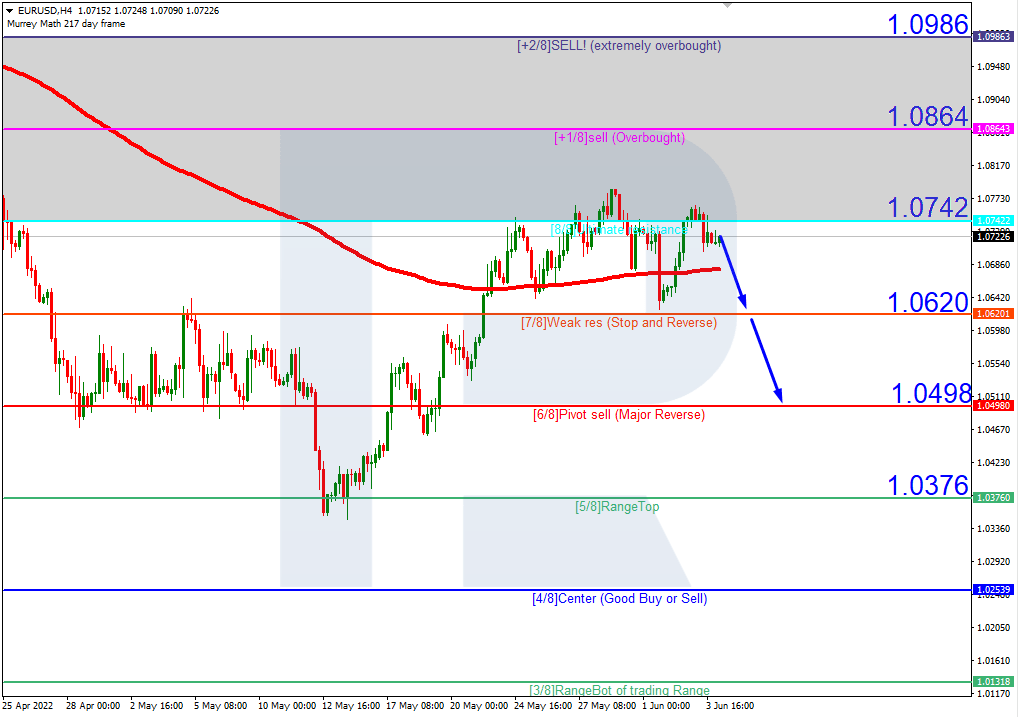

EUR/USD, “Euro vs US Dollar”

As we can see in the H4 chart, after breaking 8/8, EURUSD is no longer moving within the “overbought area”. In this case, the price is expected to test 7/8, break it, and then continue falling to reach the support at 6/8. Still, this scenario may no longer be valid if the price breaks 8/8 to the upside. After that, the instrument may reverse and grow towards the resistance at +1/8.

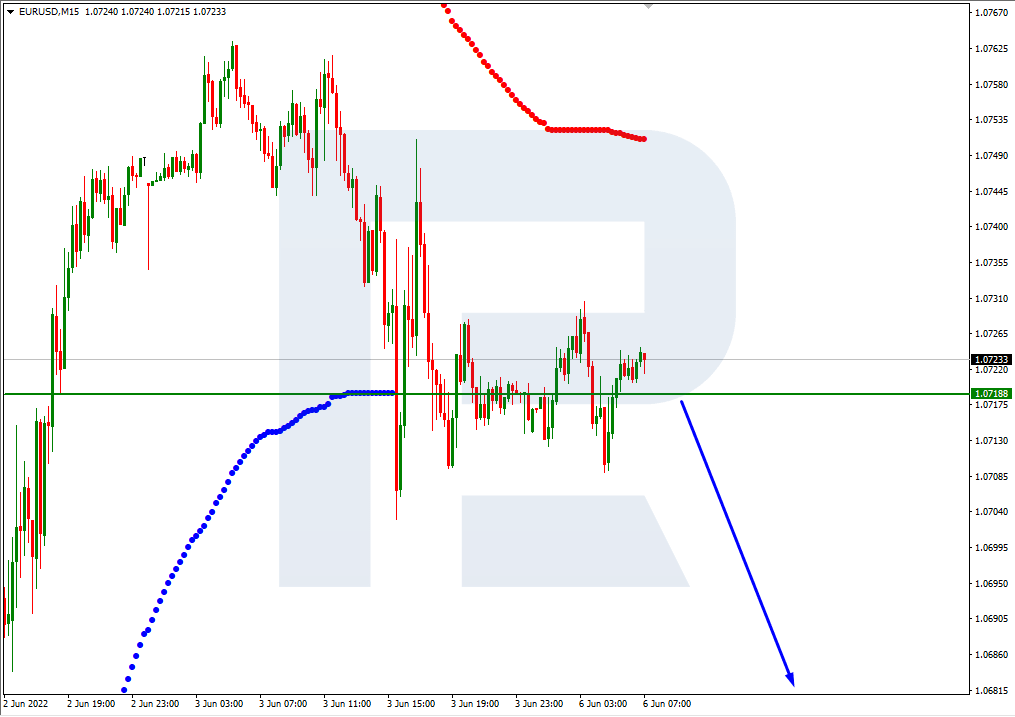

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue trading downwards.

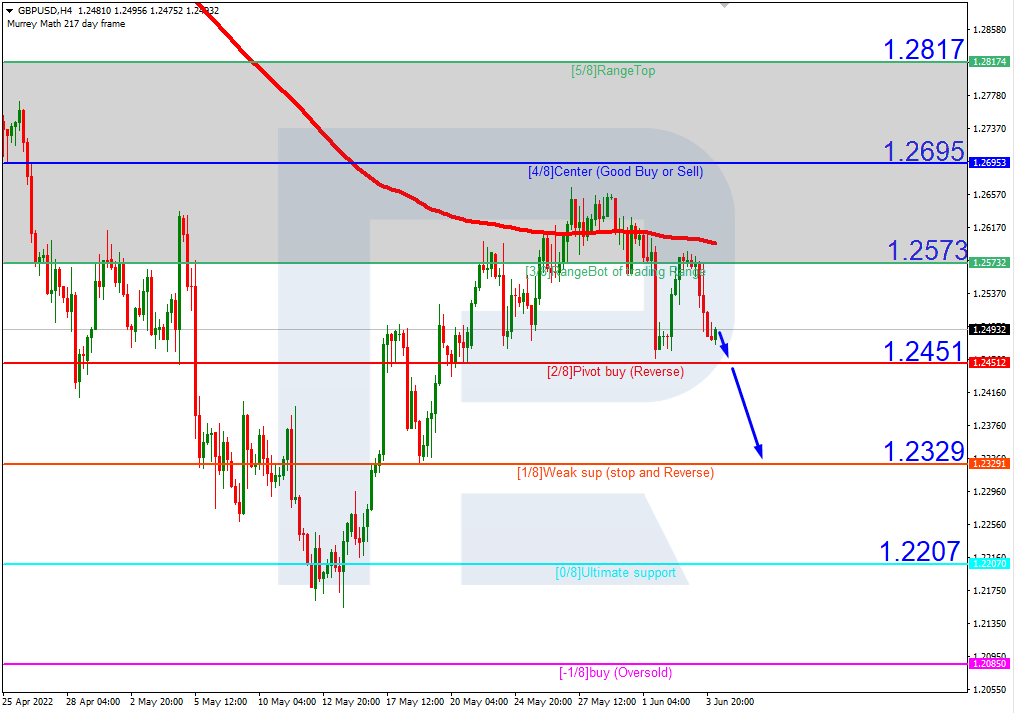

GBP/USD, “Great Britain Pound vs US Dollar”

In the H4 chart, GBPUSD is trading below the 200-day Moving Average, thus indicating a descending tendency. In this case, the price is expected to break 2/8 and then continue falling to reach the support at 1/8. However, this scenario may no longer be valid if the price breaks the resistance 3/8 to the upside. After that, the instrument may grow towards 4/8.

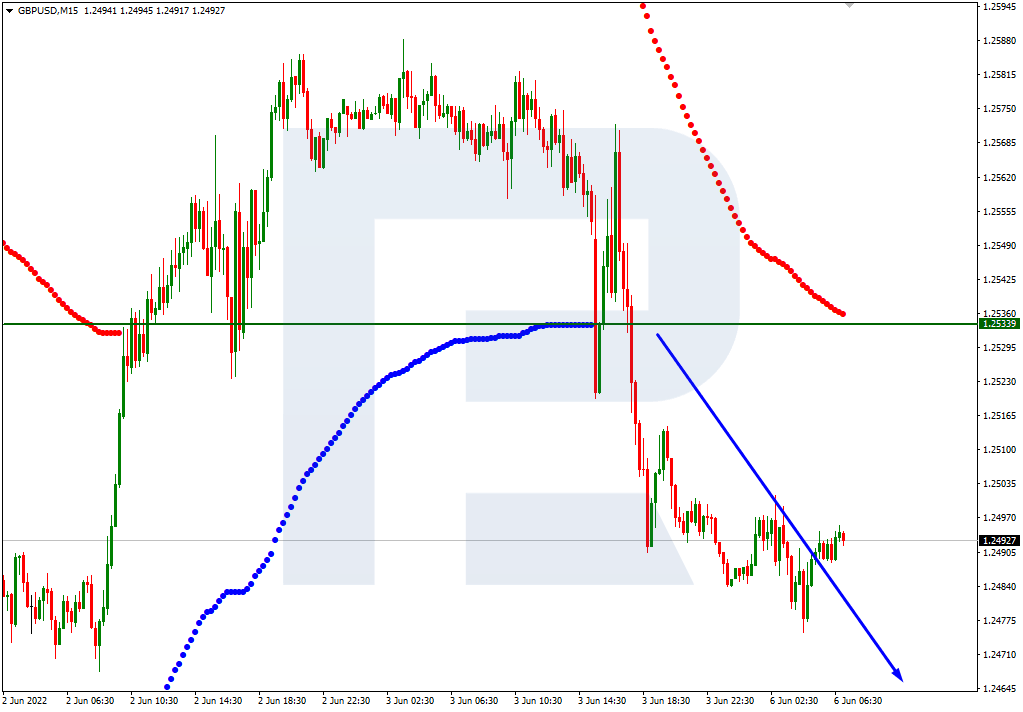

As we can see in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, continue its decline.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.