Murrey math lines: EUR/USD, GBP/USD

EUR/USD, "Euro vs US Dollar"

On H4, the quotations have bounced off 3/8. This means that a test of the support at 2/8 is quite possible, followed by a breakaway and falling to 1/8. The scenario can be cancelled by growing over 3/8. In this case, the quotations might reach the resistance at 4/8.

On M15, another breakaway of the lower line of the Volty Channel indicator will make the falling of the quotations more probable.

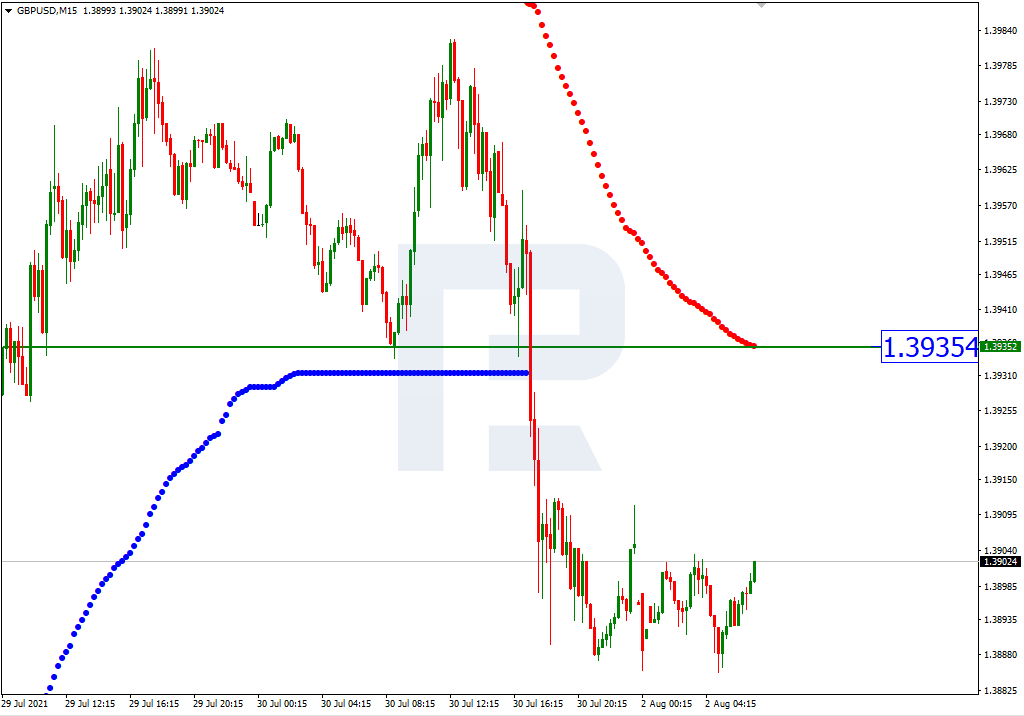

GBP/USD, "Great Britain Pound vs US Dollar"

On H4, the quotations have broken through the 200-days Moving Average and are trading under it, which might precede an uptrend. In these circumstances, we should expect a test of 4/8, a breakaway of this level, and growth to the resistance at 5/8. The scenario can be cancelled by a breakaway of 3/8 downwards. In this case, the quotations might drop to 2/8.

On M15, the upper line of Volty Channel is too high from the current price, hence, only the breakaway of 4/8 on H4 will signal growth.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.