Murrey math lines: Brent, S&P 500

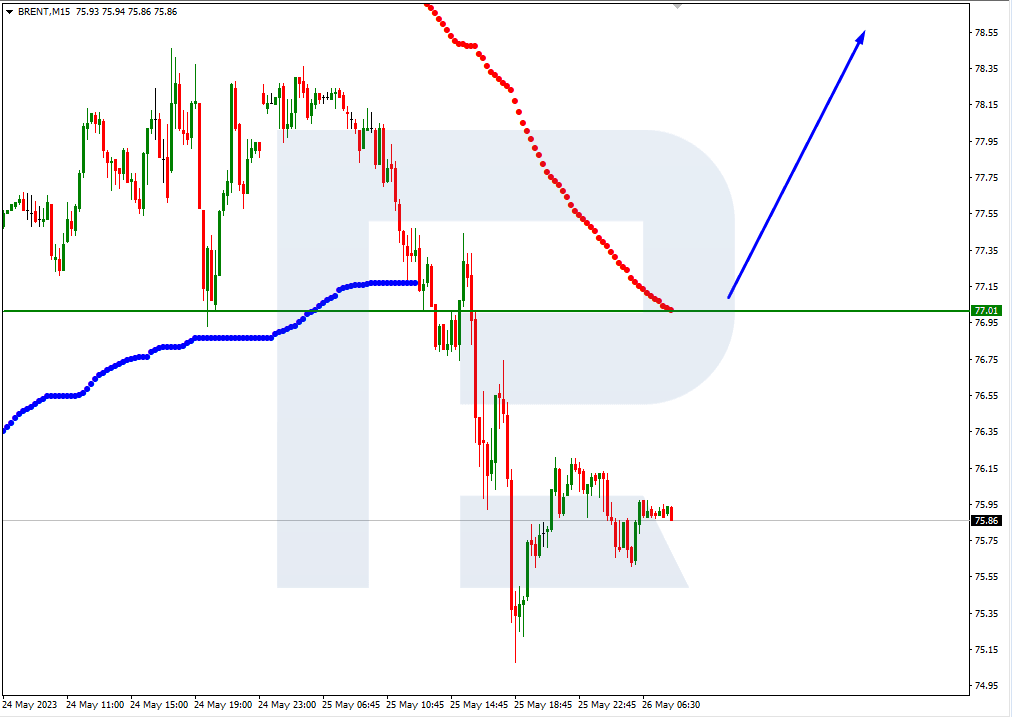

Brent

On H4, Brent quotes are testing the level of 0/8 (75.00) that acts as a support level for the price and the upper border of the oversold area. The RSI has rebounded from the support line. Currently, a rebound from 0/8 (75.00) is expected, followed by a rise to the resistance at 2/8 (81.25). The scenario can be cancelled by a downward breakout of the support at 0/8 (75.00). In this case, Brent quotes might drop to -1/8 (71.88).

On M15, a breakout of the upper line of the VoltyChannel will be an additional signal for price growth.

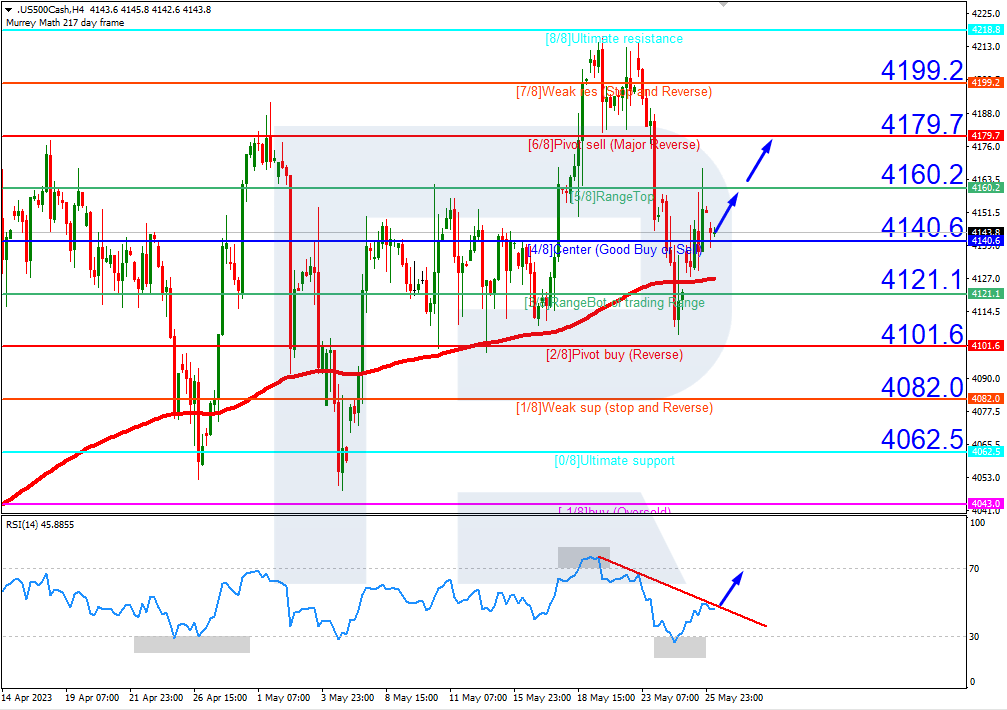

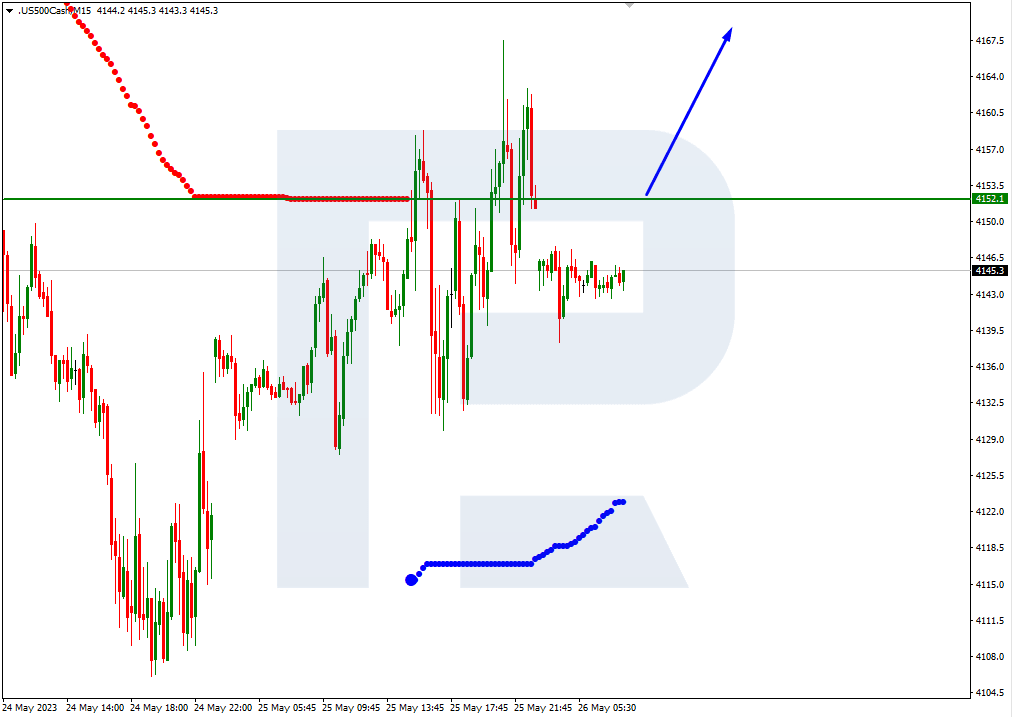

S&P 500

On H4, the quotes are above the 200-day Moving Average, which indicates the prevalence of an uptrend. The RSI is testing the resistance line. In this situation, the instrument is expected to rise above 5/8 (4160.2) and next, reach the resistance at 6/8 (4179.7). The scenario can be cancelled by a downward breakout of the support at 3/8 (4121.1), which might lead to a trend reversal and a decline of the S&P 500 to 1/8 (4082.0).

On M15, a breakout of the upper border of the VoltyChannel will increase the probability of a price increase to 6/8 (4179.7) on H4.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.