Murrey math lines: Brent, S&P 500

Brent

As we can see in the H4 chart, Brent is trading within the “oversold area”. In this case, the price is expected to break -1/8 and continue moving upwards to reach the resistance at 1/8. However, this scenario may no longer be valid if the asset breaks the support at -2/8 to the downside. After that, the lines in the chart will be redrawn, thus helping us to define new downside targets.

In the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue its growth.

S&P 500

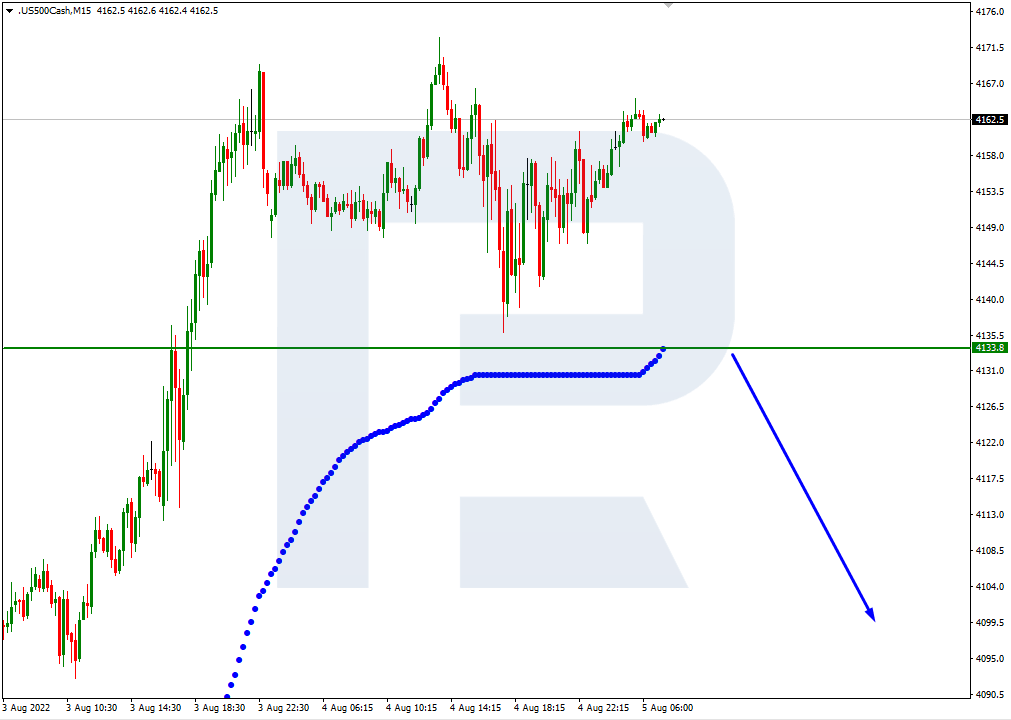

As we can see in the H4 chart, the S&P Index is still trading below the 200-day Moving Average to indicate a descending tendency. In this case, the price is expected to test 2/8, break it, and then continue falling towards the support at 1/8. However, this scenario may no longer be valid if the asset breaks the resistance at 3/8 to the upside. After that, the instrument may reverse and grow to reach the next resistance at 5/8.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue trading downwards.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.