Murrey math lines: Brent, SP 500

BRENT

As we can see in the H4 chart, Brent is moving above 5/8. In this case, the price is expected to rebound from 6/8 and then resume trading upwards to reach the resistance at 8/8. However, this scenario may no longer be valid if the price breaks 6/8 to the downside. After that, the instrument may continue falling towards the support at 5/8.

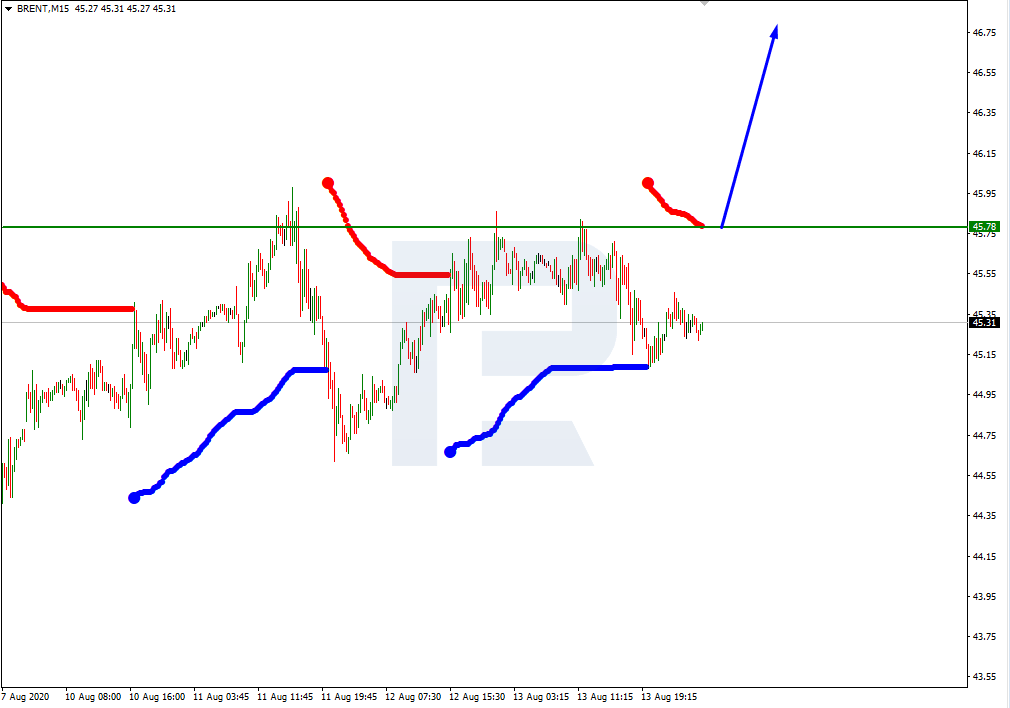

In the M15 chart, the asset may break the upside line of the VoltyChannel indicator and, as a result, continue the ascending tendency.

S&P 500

In the H4 chart, after breaking 3/8, the Index is consolidating. In this case, the asset is expected to continue growing towards the closest resistance at 4/8. However, this scenario may no longer be valid if the price breaks 3/8 to the downside. After that, the instrument may resume falling to reach the support at 2/8.

As we can see in the M15 chart, the asset has broken the upside line of the VoltyChannel indicator and, as a result, may continue trading upwards.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.