Murrey math lines: AUD/USD, NZD/USD

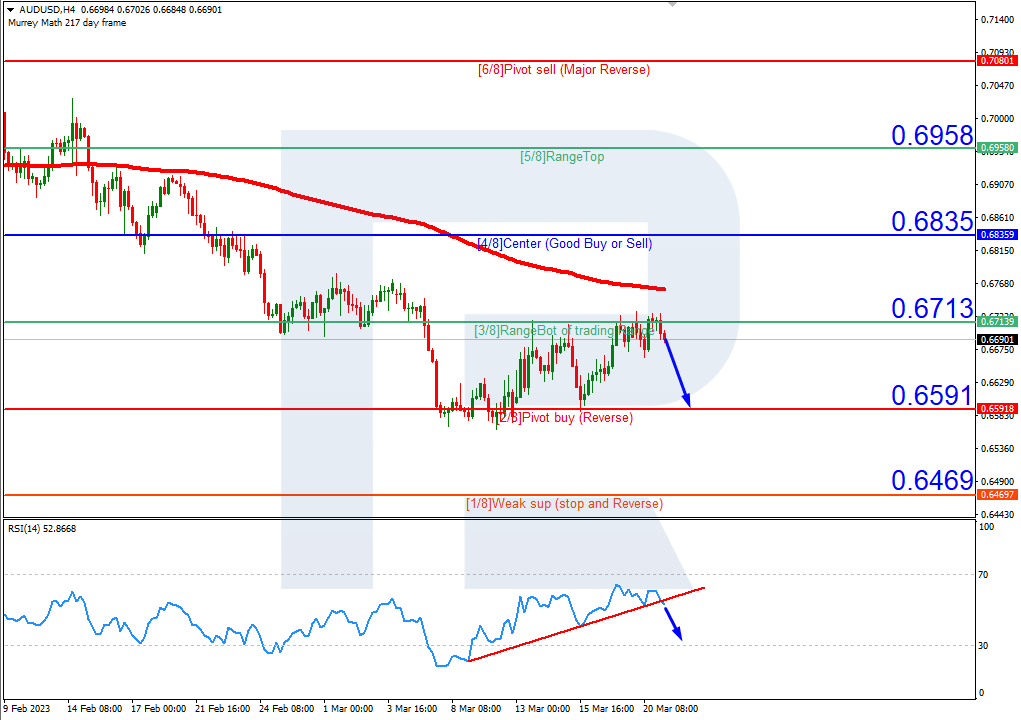

AUD/USD, “Australian Dollar vs US Dollar”

On H4, the quotes are under the 200-day Moving Average, which reveals the prevalence of a downtrend. The RSI has broken the support level. As a result, we expect the price to keep falling to the nearest support at 2/8 (0.6591). The scenario can be canceled by an upward breakaway of the resistance at 3/8 (0.6713). In this case, the pair might rise to 4/8 (0.6835).

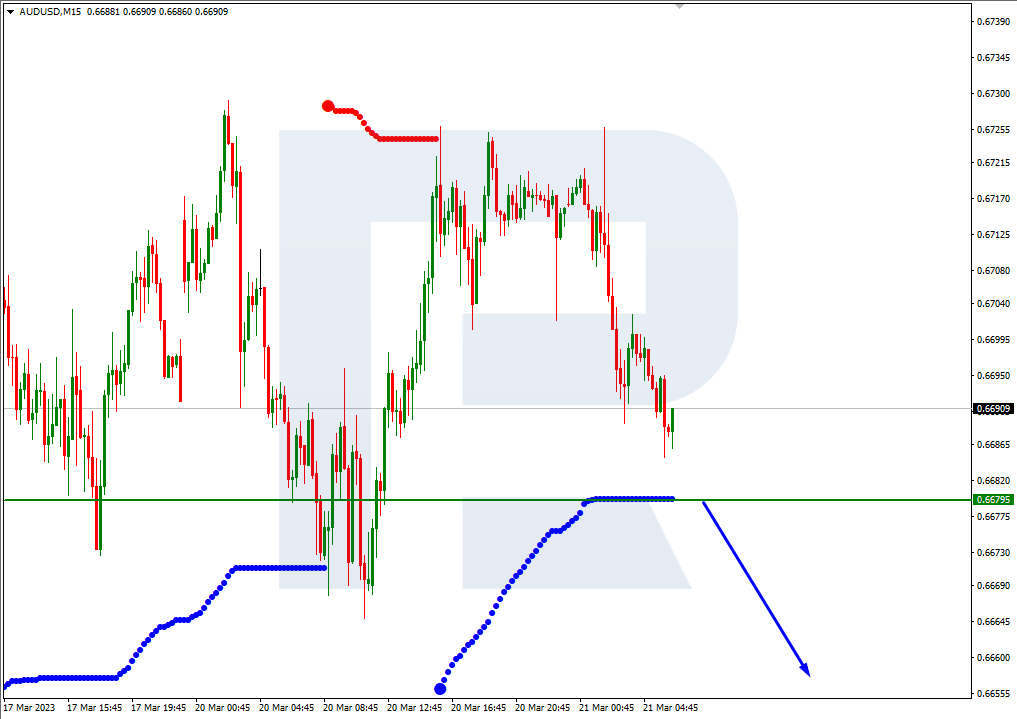

On M15, a further decline of the price can be additionally supported by a breakaway of the lower line of the VoltyChannel indicator.

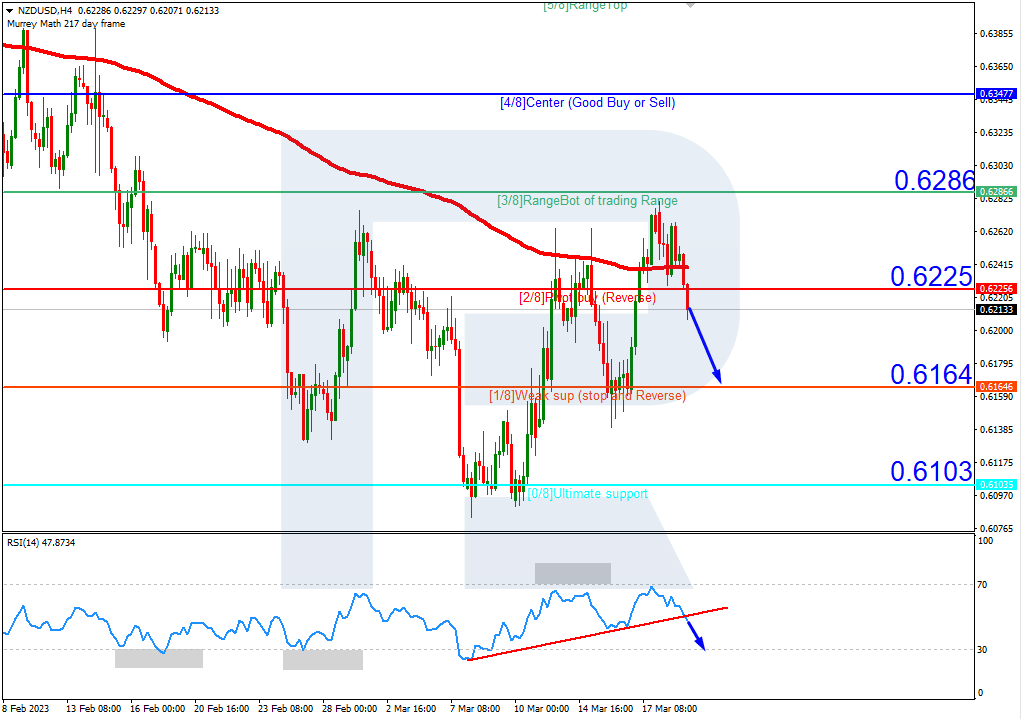

NZD/USD, “New Zealand Dollar vs US Dollar”

The situation on the NZDUSD chart is similar. On H4, the quotes are under the 200-day Moving Average, revealing the prevalence of a downtrend, while the RSI has broken the support line. In such circumstances, we expect the price to keep falling to 1/8 (0.6164). The scenario can be canceled by an upward breakaway of the resistance at 2/8 (0.6225), which might lead to a trend reversal and growth of the pair to 3/8 (0.6286).

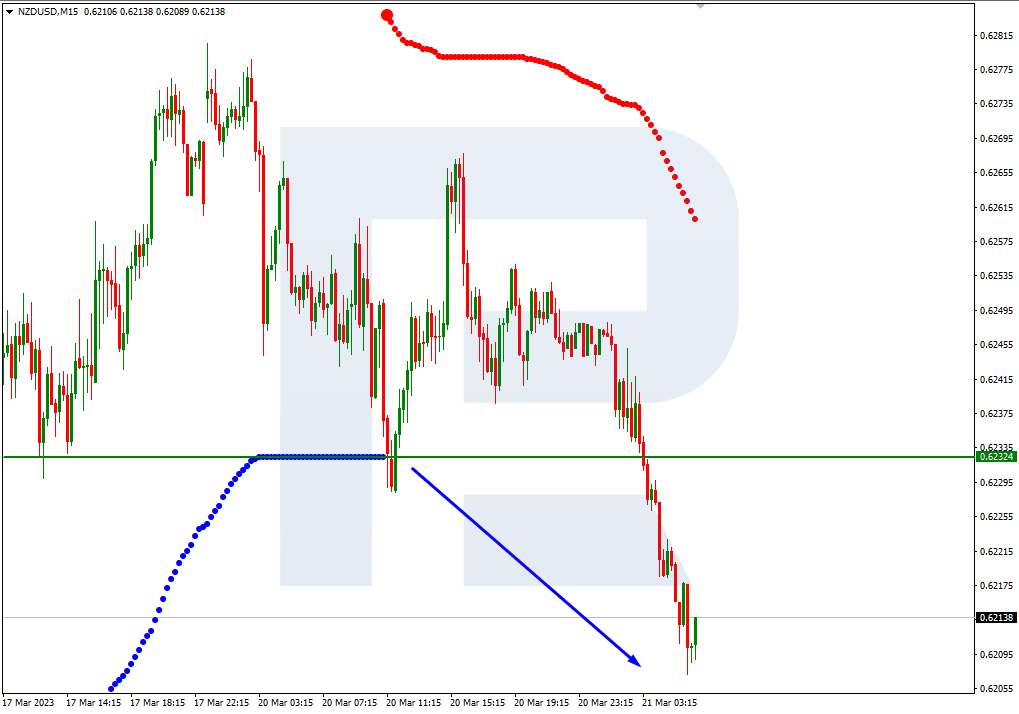

On M15, the lower line of the VoltyChannel indicator has broken. This indicates the prevalence of a downtrend and a high probability of further falling of the price.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.