Murrey math lines: AUD/USD, NZD/USD

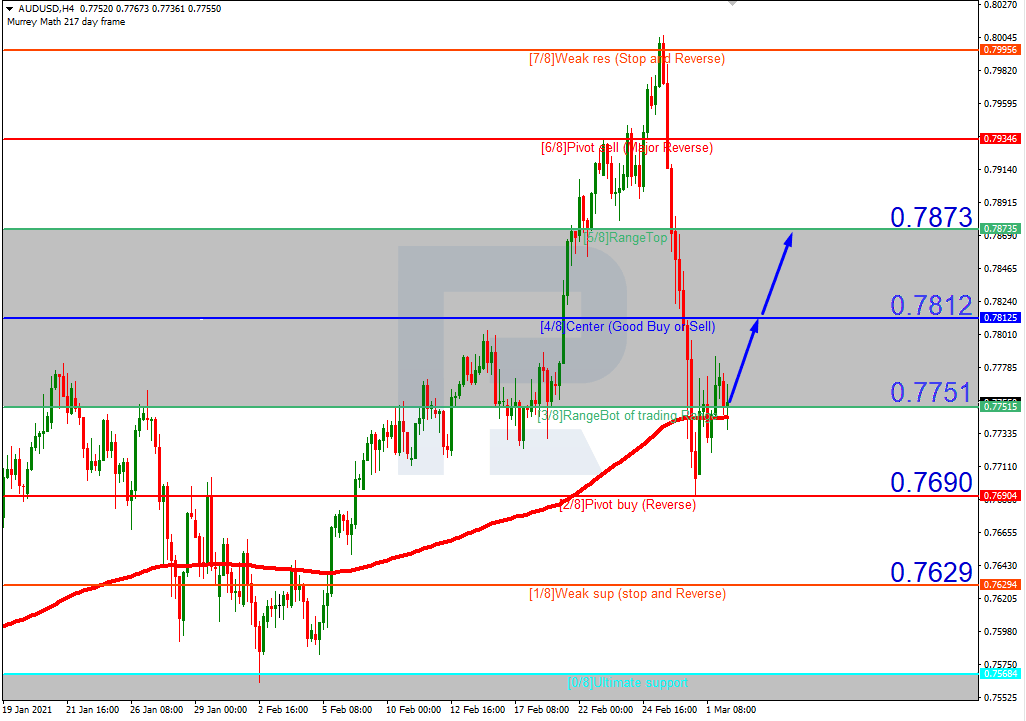

AUD/USD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, after breaking 3/8 to the upside, AUDUSD is consolidating. In this case, the price is expected to continue moving upwards to reach the upside border at 5/8. However, this scenario may be canceled if the price breaks 3/8 to the downside. After that, the instrument may fall towards the support at 1/8.

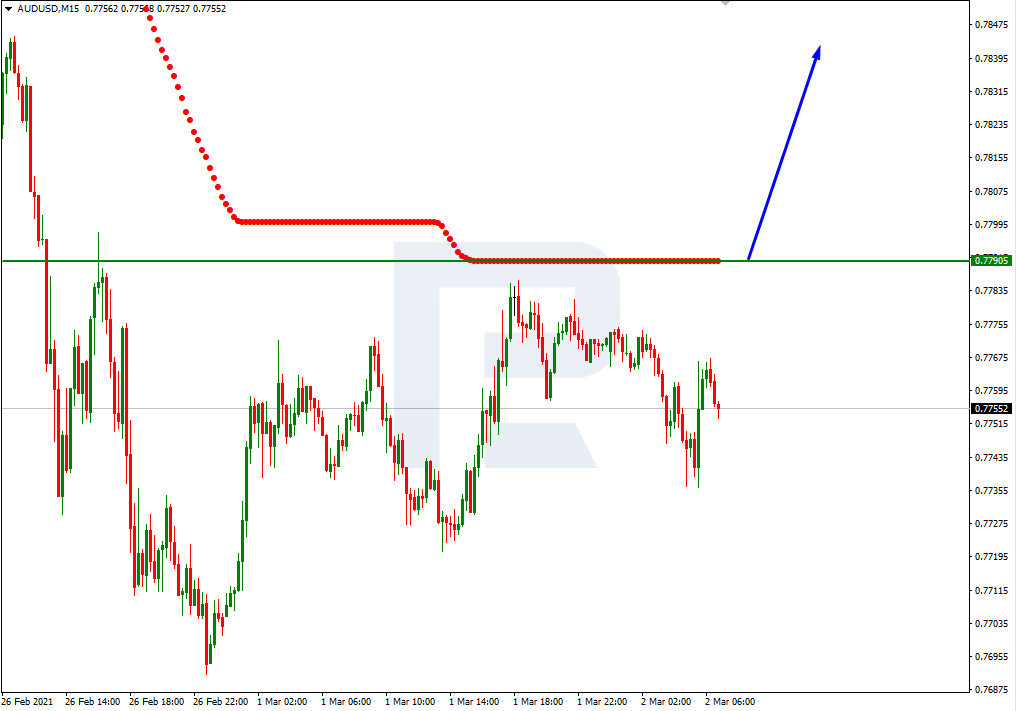

In the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue trading upwards.

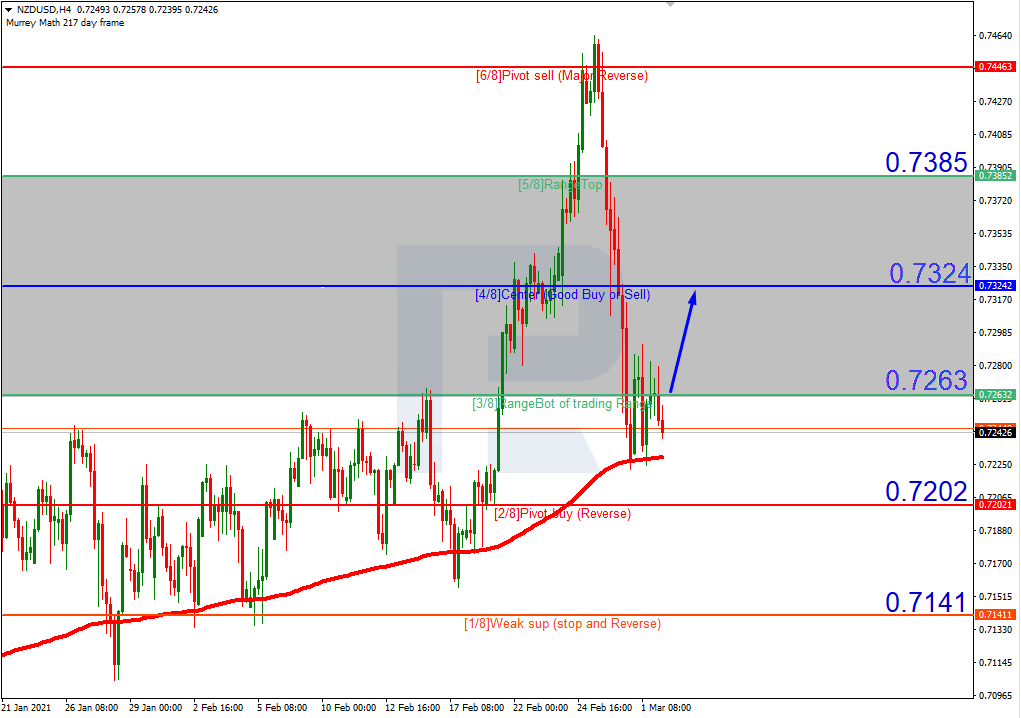

NZD/USD, “New Zealand Dollar vs US Dollar”

In the H4 chart, after rebounding from the 200-day Moving Average, NZDUSD is trading above it. In this case, the price is expected to break 3/8 and then continue growing towards the resistance at 4/8. However, this scenario may no longer be valid if the price breaks 2/8 to the downside. In this case, the instrument may reverse and fall to reach the support at 1/8.

As we can see in the M15 chart, the upside line of the VoltyChannel indicator is pretty far away from the price, that’s why the pair may continue the ascending tendency only after breaking 3/8 from the H4 chart.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.