Monthly review: December 2021 – Omicron ups and downs affect crude and indices

Overview

Welcome to our look back at the previous month and a look ahead to what we might expect to see throughout January and beyond.

As usual, the markets were driven by COVID related news, inflation, and supply chain issues. This will remain the same going into January and, to be honest, most of 2022.

As we have seen, all major cities celebrated Christmas and New Year but most tried to keep the large gatherings under control to minimise the spread of COVID. We will know, probably mid-January, with new case rates, hospitalisation rates and deaths, what the impact of Omicron will be going forward.

If Omicron and the following variants are proven to be less deadly, and less of a burden on global health services, then we will have positive news for all economies and industries for next year.

All central banks were keenly watching inflation figures throughout December and this will continue into January and well beyond as they will raise interest rates to curb inflation. The US Federal Reserve is considering 3 interest rate rises in 2022, the European Central Bank is considering none, and the Bank of England did this already in December.

GBP

UK inflation hit a 10-year high in November, forcing the Bank of England (and many other central banks) to change their minds on the “transitory” nature of said inflation. This forced the BoE to raise interest rates in the middle of December and we can see from the charts that the UK Pound has grown quite strong against its major counterparties.

However, the central bank has not made any indication that it plans to taper its bond-buying. In fact, it voted unanimously to maintain the pace in December (unlike the US Federal Reserve).

The UK labour market seems to be recovering and, despite a spike in COVID cases, the economy is as well. This leaves the BoE in a tricky situation; they can either fight inflation or boost the economy. Only time will tell going into January, and the rest of 2022, as they expect inflation to peak in April.

Like everyone, they will be looking at the data on inflation, COVID cases, employment, and GDP, before making any decisions on interest rates or tapering.

Crude oil

As we can see from the chart, Brent Crude hit the low of the month on the second day at around $66.36 per barrel and finished the year at $78, not far from the high around $80. WTI, of course, traded in a similar range from $62.90 to the final price of $75.64.

Prices increased based on the price of European natural gas going into the winter, and optimism regarding air travel, but crashed mid-month as the COVID Omicron variant got our attention.

10 days later, medical science seemed to confirm that even though Omicron is far more contagious than previous variants, the data shows that it is less deadly. This provided the optimism on future demand to boost prices to current levels.

The next meeting of OPEC+ will occur on 4 January and the consensus is that we will see a production increase which will see prices fall.

So, going into January and the rest of 2022 the market will be watching OPEC+, COVID statistics, air travel statistics, and the severity of the current winter temperatures.

Many investors and analysts feel the intervention of green energy projects and regulations will see lower demand for crude. This is probably true but, to be honest, it will take longer than 2022 to see any real difference in demand for crude.

CAD

Normally we see the price of crude oil driving the Canadian Dollar but, inexplicably on the last day of the year, we saw a huge rally on all CAD pairs.

Price action on all CAD pairs pretty much finished December at similar levels to the beginning, with a wild ride in between.

The Bank of Canada is looking at doubling its current interest rate of 0.25% by the end of 2022. We don’t have a date for this yet so, going into the first few days of January, with better market liquidity, we might look for a CAD reversal on the back of the 31 December rally.

USD

Last month we were commenting on the strength of USD. As the year comes to an end, we see the opposite with the only exception being USDJPY.

The charts also show multi-week rising wedges forming on EURUSD, NZDUSD, AUDUSD and GBPUSD, so we might be looking at technical reversals going into January.

This predicted strength of USD seems logical as the Fed will be implementing their tapering strategy and implementing their 3 interest rate rises during 2022.

Labour shortages still plague the US economy and the Department of Labour are blaming COVID fear for keeping people at home and out of the workforce. Many analysts are sceptical about the data derived from surveys. Personally, we feel that once people’s savings start to run dry, they will be forced back into their old jobs.

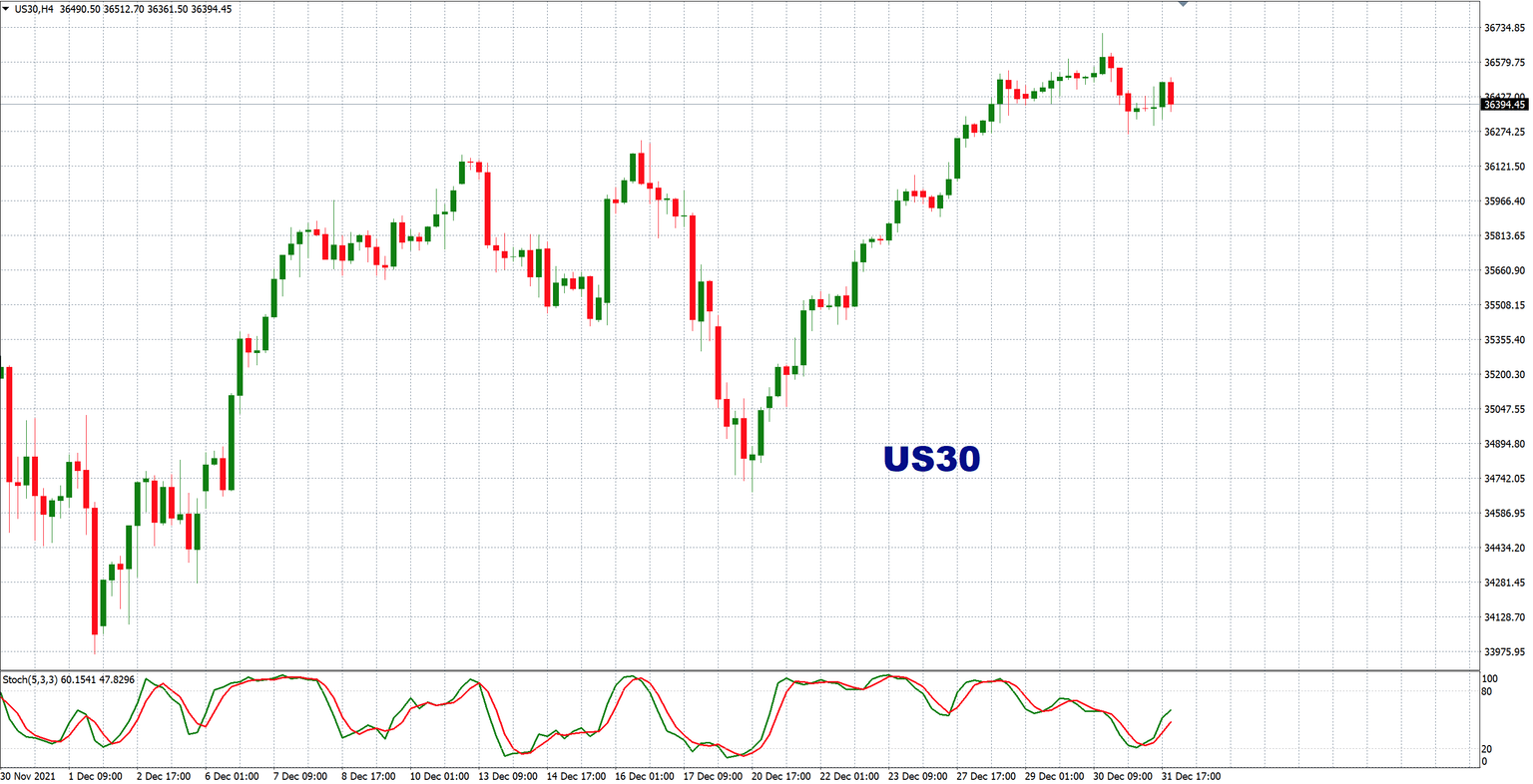

US equities

The chart on the Dow Jones Industrial Average tells the story. We saw good beginnings to the month based on a lower unemployment rate and no immediate Interest Rate rises, but with the threat of COVID Omicron, which has an extremely high rate of contagion, we saw some major dips mid-month.

Medical science, however, seems to be telling us that the new variant is less deadly than previous, so optimism struck investors once again and we saw a positive Santa Claus rally going into the last week of the month with the DJIA and the S&P 500 reaching all-time highs. The NASDAQ followed the same path, but it could not regain its all-time high set in November of this year.

Going into January and beyond, we see optimism in the markets as long as new variants of COVID do not swamp hospitals and cause lockdowns again.

Gold

After a huge fall on the last day of November, XAUUSD started the month at $1,777 and followed a wild path to close out the year at $1,829.

As we mentioned above, we saw USD weakness this month which was the most likely driver of Gold in December. We also mentioned a possible reversal of USD which would see XAUUSD falling.

Also, a critically important factor for Gold traders is the percentage level of US bond yields which are inversely correlated to the price of Gold. So, when the US Federal Reserve starts its tapering program, we will see bond yields rise, thereby offering a safe haven for investors away from Gold. This will see the price of Gold falling.

Author

Brad Alexander

FX Large Limited

Brad became fascinated with the Currency Markets from a young age and researched fundamental analysis.