Momentum meets complacency

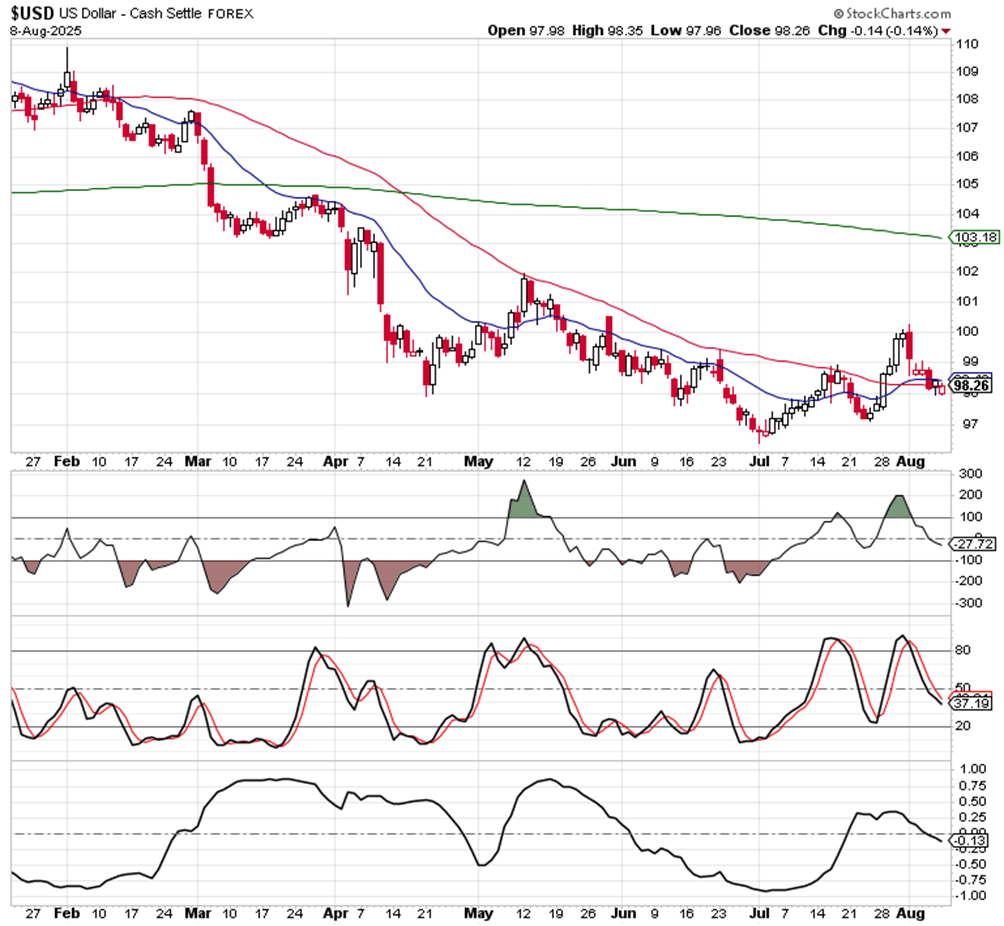

S&P 500 couldn‘t really retest 6,360s Friday, it just rose with two intraday exceptions in a straight line. 6,430s would be the logical area to clear to maintain the upswing(‘s bullish prospects) – so what are financials, tech and industrials doing while the dollar is carving out a local bottom (will that be in the 98 area) or is it rolling over again? I‘m discussing these charts, value vs. growth and long-dated bond yields pulling higher last four sessions in a row in the client part of today‘s article.

EURUSD 1.1640 is an important area, and 1.1670 held Friday, with regular session‘s close bringing USD buying and equities buying (that‘s what swing trading clients welcome) as SMH, XLK and XLY ticked up, and XLF stabilized Friday considering preceding day‘s weakness. Which way would XLI tip the scales in the „we know a rate cut is coming soon just check HD, TOL, ITB“?

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.