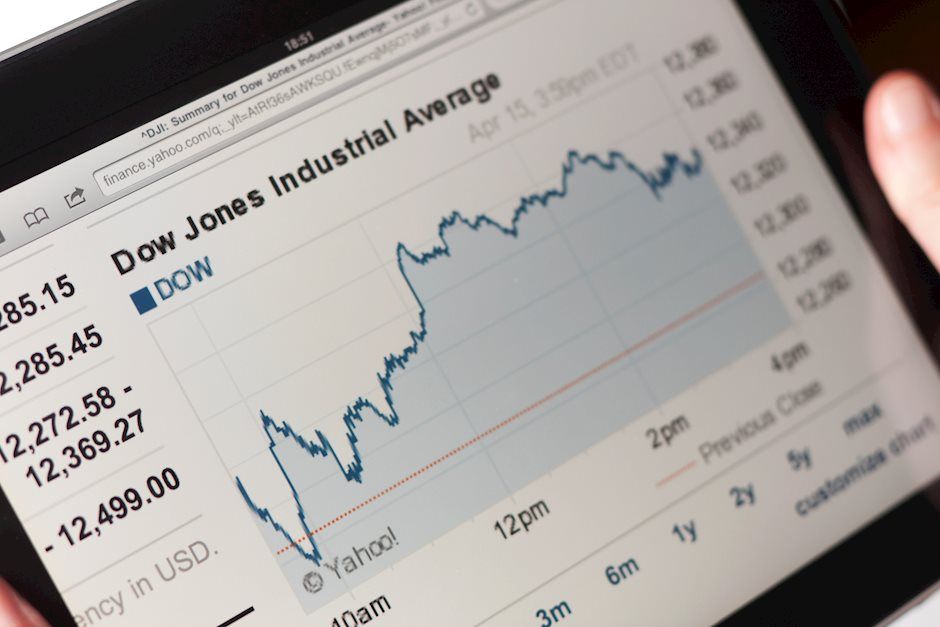

Mid-afternoon market update: Dow tumbles over 300 points, Federal Reserve maintains interest rates

Toward the end of trading Wednesday, the Dow traded down 0.92% to 33,983.29 while the NASDAQ fell 0.68% to 13,977.59. The S&P also fell, dropping 0.74% to 4,215.21.

The U.S. has the highest number of coronavirus cases and deaths in the world, reporting a total of 33,486,910 cases with around 600,280 deaths. India confirmed a total of at least 29,633,100 cases and 379,570 deaths, while Brazil reported over 17,533,220 COVID-19 cases with 490,690 deaths. In total, there were at least 176,682,210 cases of COVID-19 worldwide with more than 3,823,780 deaths, according to data compiled by Johns Hopkins University.

Leading and Lagging Sectors

Financial shares rose 0.1% on Wednesday. Meanwhile, top gainers in the sector included The Duckhorn Portfolio, Inc. NAPA 2.92%, up 3%, and Vital Farms, Inc. VITL 2.37%, up 2%.

In trading on Wednesday, consumer staples shares fell 1.2%.

Top Headline

The Federal Reserve maintained its target fed funds rate range of between zero and 0.25%.

Eleven Fed members see no change to interest rates through at least 2022. Five members forecast rates will rise by 0.25% by the end of 2022 and two members forecast a 0.5% rise. All but five members now forecast at least one rate hike by the end of 2023.

Equities Trading UP

Kindred Biosciences, Inc. KIN 45.58% shares shot up 45% to $9.21 after Elanco announced an agreement to acquire the company for $9.25 per share.

Shares of Aprea Therapeutics, Inc. APRE 10.93% got a boost, shooting 21% to $5.88 after the company announced that the Phase 1/2 trial evaluating eprenetapopt in acute myeloid leukemia (AML) has met the pre-specified primary efficacy endpoint of complete remission (CR) rate.

Forward Industries, Inc. FORD 15.75% shares were also up, gaining 11% to $3.0312 after the company announced a U.S. distribution agreement with Chipolo.

Equities Trading DOWN

Paratek Pharmaceuticals, Inc. PRTK 12.12% shares tumbled 12% to $8.99. Paratek Pharmaceuticals initiated Phase 2b trial evaluating Nuzyra (omadacycline) for Nontuberculous Mycobacterial (NTM) Pulmonary Disease caused by Mycobacterium abscessus complex (MABc).

Shares of Inhibikase Therapeutics, Inc. IKT 27.14% were down 29% to $2.8701 after the company priced an underwritten public offering of 15 million shares at $3/share for gross proceeds of approximately $45 million.

Blue Apron Holdings, Inc. APRN 22.27% was down, falling 22% to $4.2950 after the company priced public offering of 4.706 million shares of Class A common stock at $4.25 per share.

Commodities

In commodity news, oil traded down 0.2% to $71.96, while gold traded down 0.8% to $1,842.40.

Silver traded down 0.5% Wednesday to $27.56 while copper rose 0.1% to $4.3380.

Euro zone

European shares closed mixed today. The eurozone’s STOXX 600 gained 0.23%, the Spanish Ibex Index fell 0.31% and the German DAX 30 fell 0.12%. Meanwhile, the London’s FTSE 100 gained 0.17%, French CAC 40 climbed 0.20% and Italy’s FTSE MIB rose 0.12%.

UK’s producer prices rose 4.6% year-on-year in May, while consumer price inflation rate increased to 2.1% year-over-year.

Economics

Housing starts rose 3.6% to an annualized rate of 1.572 million in May, while building permits fell 3.0% to a 1.681 million rate.

US import prices increased 1.1% in May, while prices for exports climbed 2.2%.

US crude-oil inventories dropped 7.4 million barrels last week, the Energy Information Administration said.

The Federal Reserve maintained its target fed funds rate range of between zero and 0.25%.

Author

Benzinga Team

Benzinga

Benzinga's news desk is a dynamic and innovative team that provides real-time, actionable articles that help readers navigate the market.