Markets Tumble Despite IMF $50B Aid Pledge

The optimism in the markets following the IMF pledging $50 billion in aid to fight the coronavirus outbreak was short-lived.

After the state of California declared an emergency, equity markets continued to fall.

So far, the sell-off in the equity markets has been one of the worst since the 2008 financial crisis. The volatility index from CBOE rose to 34.54 points mid-day.

Italy Seeks Suspension of EU Budget Rules

Italy, one of the worst hit countries outside of China by the Coronavirus, is expected to seek a budget exemption from the EU budget rules.

The deputy minister said that his government is considering increasing its spending to fight the epidemic to 5 billion euros from 3.6 billion previously. This comes as Italy already stands as one of the most highly indebted countries in the eurozone.

EUR/USD Struggling Near Resistance

The common currency’s momentum is somewhat slowing. It trades at the resistance level of 1.1177 and the 1.1200 region. However, as the Stochastics oscillator remains firmly in balance, we anticipate price to eventually breakout higher. A daily close above this level, including some momentum, could keep the bullish trend alive.

OPEC Cuts Oil Production, Awaits Russia to Get on Board

OPEC member nations agreed in Vienna on Thursday to curb oil production by 1.5 million barrels per day in the second quarter of 2020. The move comes despite Russia staying non-committal to the production cuts. The move comes as OPEC nations attempt to keep oil prices stable in the aftermath of the virus outbreak.

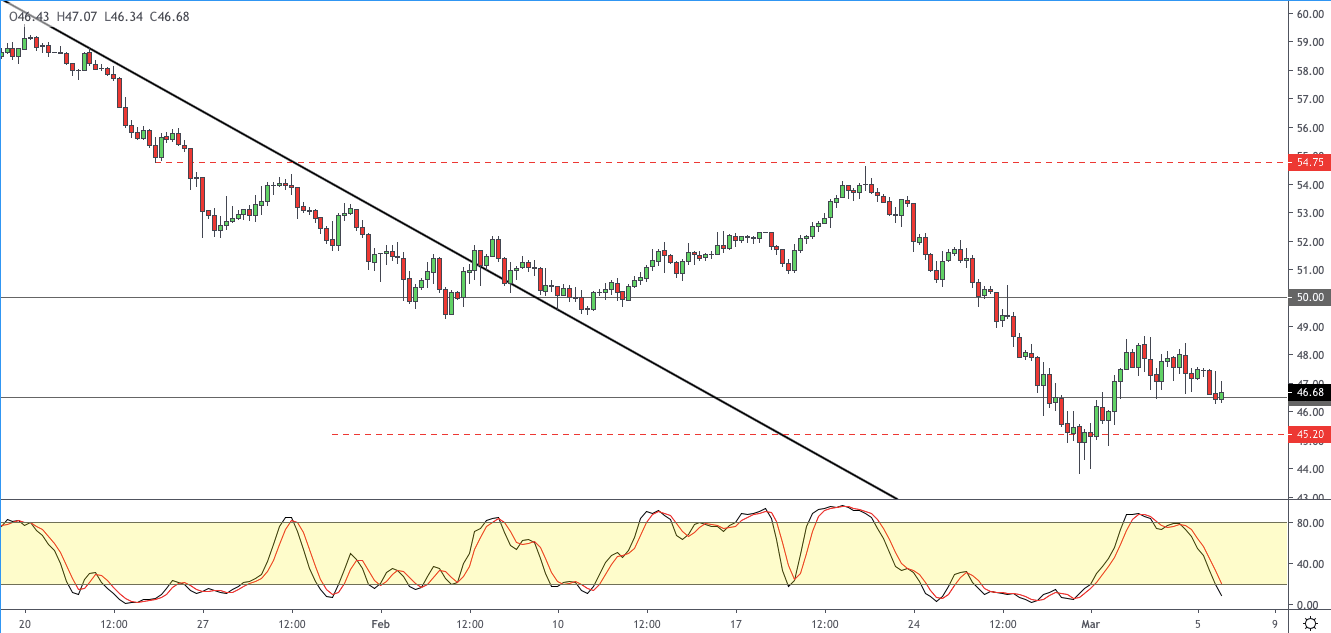

WTI Crude Oil Slips Back to Support

WTI crude oil prices gave up the modest gains made earlier in the week. Prices are now testing the support area of 46.50. This level could prove to be crucial. A downside breakout will trigger declines to the 45.20 region. Alternatively, if the support holds, we expect the gains to see a push-through to the 50.00 resistance.

Gold Prices Rise on Fear

With many publicly listed companies providing weaker forward guidance and questions of whether the Fed’s rate cut will be able to do anything, gold prices are riding high. The precious metal is up over 1.50% on the day as equities take a tumble and risk aversion remains high.

XAU/USD Next Target: Feb 24th Highs

After consolidating within the 1655 and 1631 levels, gold prices broke out to the upside. The breakout above 1655 will now see the precious metal challenging February 24th highs of 1682. This is possible if the current momentum remains in play. To the downside, the price level of 1655 could support the price declines in the short term.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.