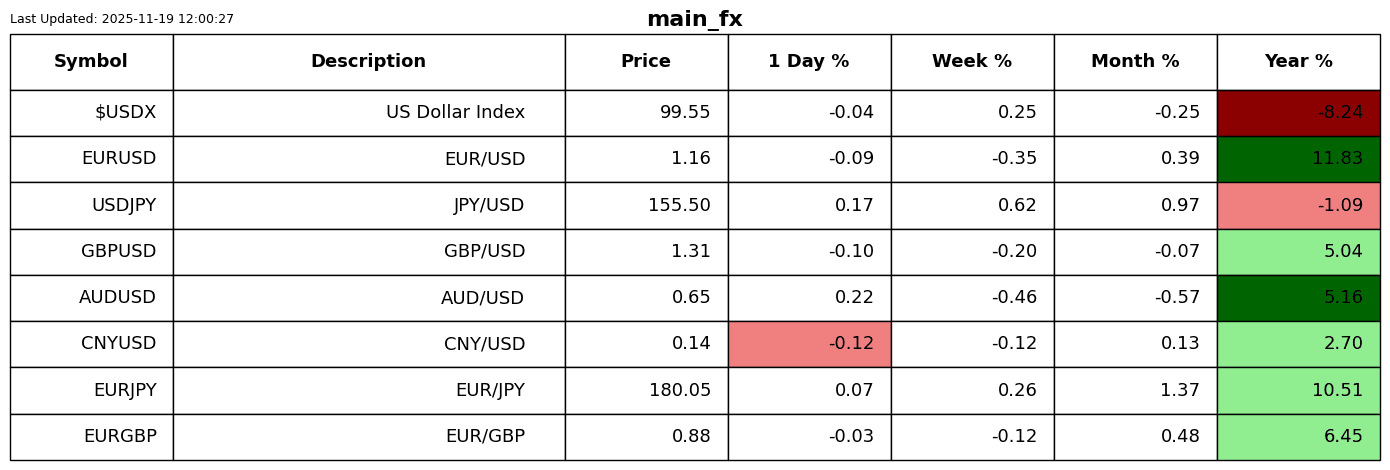

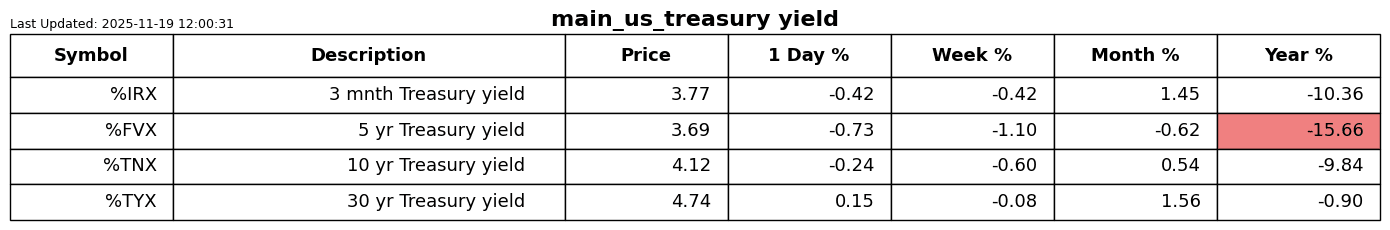

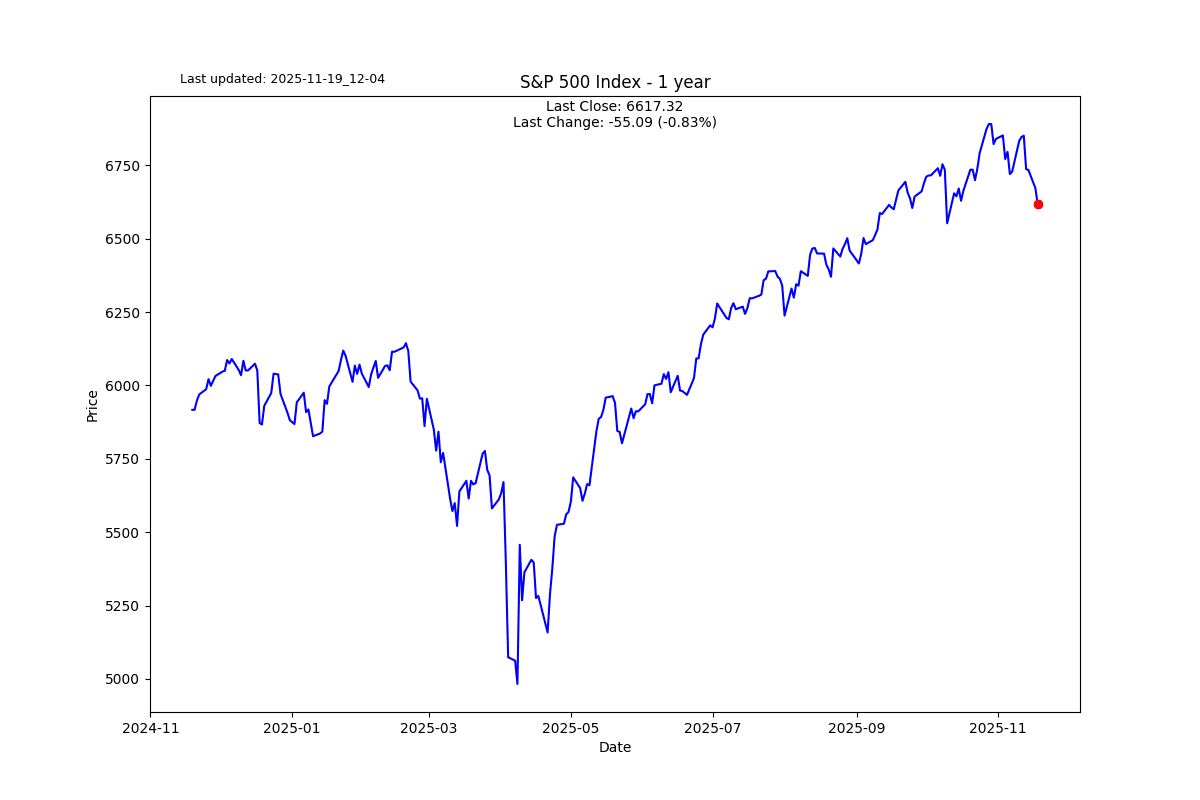

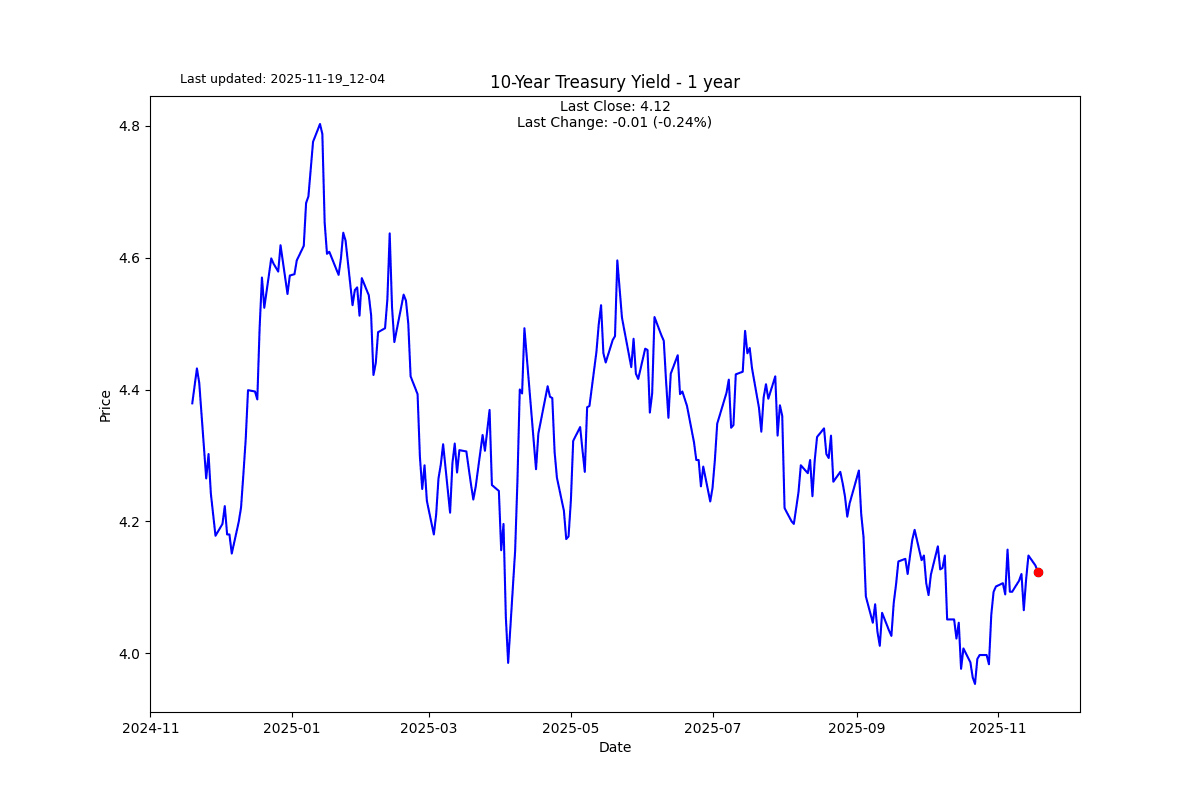

Markets are in the process of deciding the course of action for the next few months

S2N observations

I will make some loose observations here, as it feels like the markets are in the process of deciding the course of action for the next few months or perhaps longer. This feels like a pivotal moment that will dictate price action for some time.

I think one of the greatest dangers to investing and trading (unless you are a day trader) is watching the prices of your investments gyrate up and down. It puts your mind on a perpetual cycle of deciding whether to do something or not. As they say in the classics, nothing good comes from staring at a screen of moving figures.

On this subject yesterday I found myself staring at Bitcoin for large parts of the day. I watched it drop below 90,000 and found myself completely emotional. It was reminding me of my days as a co-founder of a high-frequency Bitcoin and Ethereum market maker (TrueAlpha was its name; may it rest in peace).

I am sure many of you are not familiar with the drama that goes into running a system that moves limit orders about 3 or 4 times a second. We lived (barely) through days where Bitcoin moved 10% a day. Remember, a market maker is offering to buy when sellers are selling and sell when buyers are buying. When big moves happen, it is like the proverbial being run over by a steamroller. You print money most of the time only to give back large sums when the trend unexpectedly continues without pause.

The talk around town is that many market makers in crypto have been blown up over the last week or so. While watching Bitcoin price action yesterday, I was anticipating that it could be a waterfall day. In the midst of my screen gawking, I got a call from a market maker calling from a flight 37,000 feet in the air, wondering if his book was solvent; he was unable to get a reliable connection to his P&L, so he texted me to take the temperature. I don’t miss the adrenaline and anxiety that comes from a game that has zero tolerance for mistakes.

There is a reason why I mention all of this, as I think Bitcoin specifically and crypto more generally are windows into the eyes of the market’s animal spirits. When good news is good news and bad news is good news, you are under the spell of an archetypal market complex.

The above chart of Bitmine Immersion Technologies is the company that Tommy Lee, the guy with the big hair and buy-the-dip mantra, aka the market strategist from FundStrat pivoted to becoming an Ethereum Treasury like MicroStrategy. These guys are buying like crazy. I stand by my views that MicroStrategy and Bitmine will destroy value for investors who buy their stock at a premium to the underlying NAV of the crypto they are holding.

Finally some AI from a different angle.

Jason Zweig wrote an excellent article in the Wall Street Journal on how the big technology companies have produced incredible returns on capital invested, as they have typically been “capital-light” businesses. But now with the AI buzz, they have become so capital intensive, he writes: “Big tech companies are expected to spend nearly $3 trillion on AI through 2028 but only generate enough cash to cover half that tab.”

I know I am yapping on here, but I always like to share use cases, and I have been one for the last few days. I have mentioned a few times that I am working on an exciting new software project. I am anticipating a December launch. One of the modules I am building provides an AI assistant. I wanted to ship an LLM within the product so that it came out of the box and with no cost, versus a user having to provide api credentials to their OpenAi or Claude subscriptions.

For the last 2 full days I have been working with all the open-source LLMs, trying them out. Wow, what a job. Firstly, to get started, you need to download a 4-gigabyte model that takes up a sh1tload of memory, is slow and, with only 7 billion parameters, is super hard to get decent contextual responses from. Using a server-based approach to improve speed comes at a huge computational expense on a laptop. What I am getting at is that I got a sense of why OpenAi, Anthropic, Gemini et al. have a monopoly on this space at the moment. The cost we are paying is unsustainable; it is literally for nothing, relatively speaking, so I will be changing my approach and shipping the software with 3rd-party AI. There is no point in trying to provide free value but with crappy results. There are sinister overtones to my comments, and the Jason Zweig quote is not to be dismissed. I think these AI companies are going to have to pass on the costs to the consumer eventually, which will be inflationary. In the meantime, take advantage of the incredible value we are getting from these companies.

S2N screener alert

The most expensive auction price for a painting of modern art was achieved yesterday. $236 million for a Gustav Klimt. Goodness gracious me, but that is an awful lot of money to pay for a painting. Records like this are often associated with peak animal spirits.

Believe it or not, that’s still cheap considering the $450 million paid for Leonardo da Vinci’s “Salvator Mundi,” that Christie’s sold in 2017.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.