Market Talk – October 24, 2016

A healthy start to the final full week of October with promising data aiding markets globally. In Japan we saw better than expected September Exports (6.9% against a forecasted 10.4%) lifted the Nikkei in afternoon trade to close up 0.3% on the day. This was also supported by the October PMI which came in at 51.7 against the previous months 50.4; providing the fastest rise this year. Shanghai and Hang Seng both returned strong sessions today with closes up around 1% better on the day. Also for China the off-shore Yuan continues to weaken and this evening was trading at 6.7845.

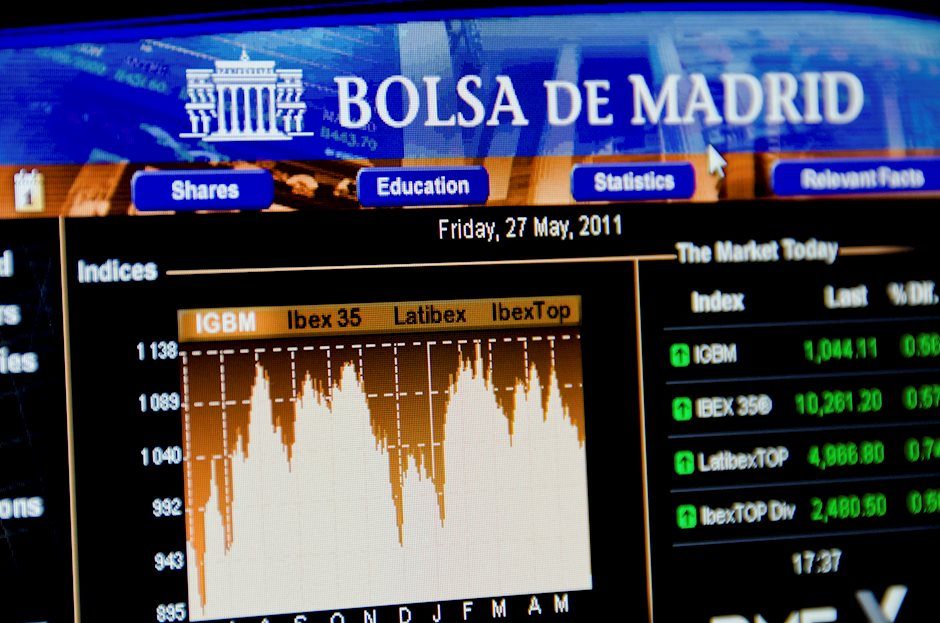

A little clarity over the political situation in Spain certainly helped the IBEX today, closing up almost 1.5% on the day. Other European indices also saw strong returns with the CAC and DAX both closed around 0.4% higher on the day. It was not such a pleasant day for the FTSE in the UK after much talk questions the focal point of the City of London and its dominant role in the financial markets. FTSE closed down 0.5% with GBP also coming under pressure for the majority of the day only to rally into the US close. The selling remains heavy as the uncertainty continues to dominate headlines.

It was the USD that again grabs todays headlines, followed by corporate profits which all helped support the strong opening for stocks. The DOW was into triple digit gains just after the opening bell but tended to drift as the session wore on. We have seen good results for over two-thirds of the S+P index now and all look to be gaining in confidence with M+A activity the talk for many. Oil did see some drift but remains above the psychological $50 level. The DXY futures closed this evening at 98.78 having seen an intra-day high of 98.84. The target probably for year end has to be the January highs of 99.82.

Bonds drifted almost everywhere today with curve steepening the theme for the day. US 2’s closed 2bp higher at 0.84%, whilst 10’s closed 1.76% (+3bp). In Europe the German Bund closed back in positive ground at +0.02% which closes the US/Germany spread at +174bp. Italy closed 1.39%, Greece 8.27%, Turkey 9.61%, Portugal -4bp after retained its BBB credit rating at 3.12%. Finally, UK Gilt 10’s closed 1.08% (unchanged).

Author

Martin Armstrong

Armstrong Economics

Armstrong pursued his studies of economics searching for answers behind the cycle of boom and busts that plagued society both in Princeton and in London.