Many factors involved

S2N spotlight

I am going to make a statement based on decades of observation and research. I will then contradict this statement afterwards, and in the end I will stand by both statements.

Each day as we wait for the latest data release, the talking heads, the forecasters, the charlatans, and the fools will react to the data, usually with an inflated sense of certainty. The problem is no one factor is able to provide enough “signal” to the direction of the underlying market.

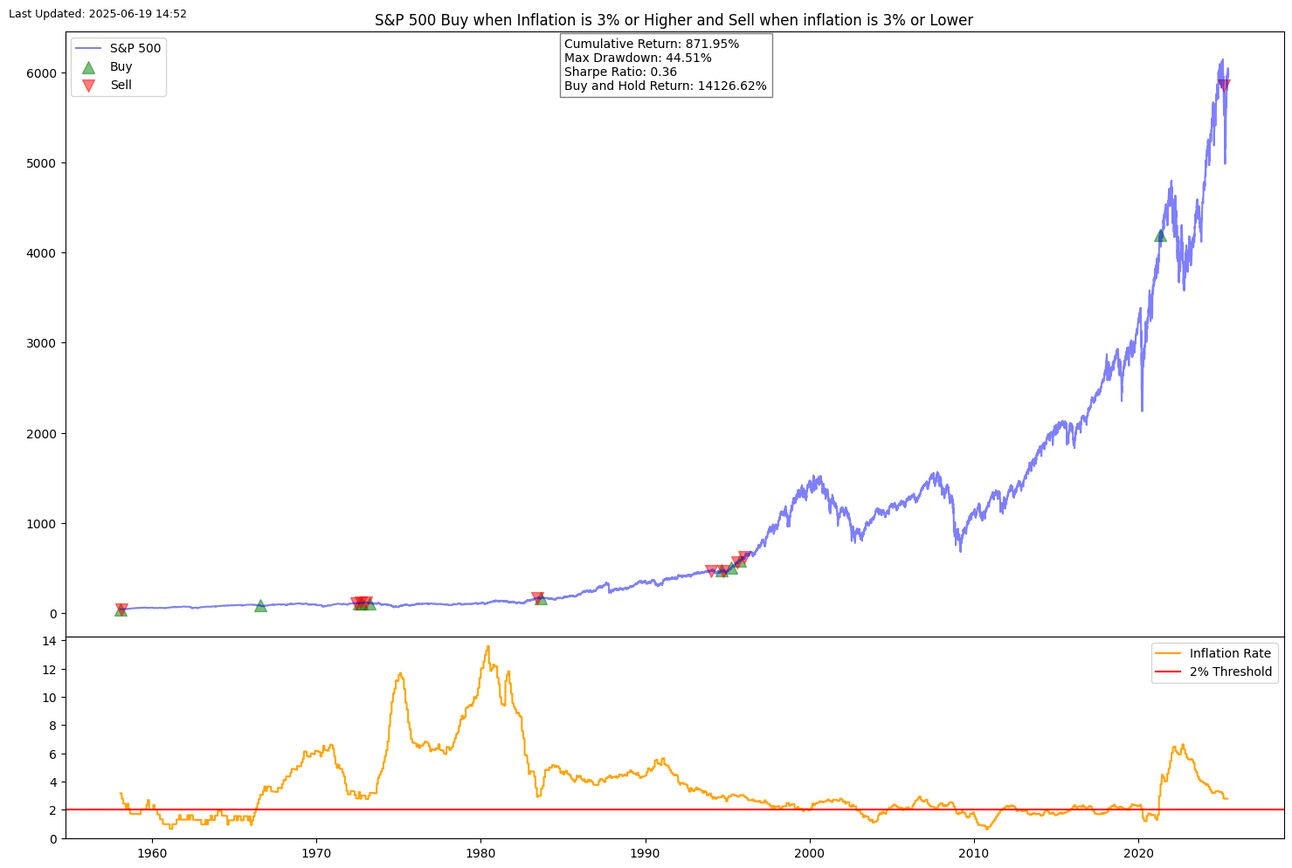

Take the example below. We invest in the S&P 500 when inflation is below 3% and sell when it is above. This proves to be a very poor performer in comparison to buy and hold.

If you think I have got my logic mixed up and rather you should invest when the inflation rate is above 3%, then you would be wrong again; your returns would be half of when you invest when inflation is low.

While I don’t believe one factor, such as inflation or interest rates or any of the other indicators, can provide you with a strong enough market timing signal, I strangely believe the actual price time series itself can provide you with enough information to draw out a signal.

Price Contains Everything: The actual price time series represents the collective wisdom (and folly) of all market participants processing all available information in real-time. It's the output of the entire system, not just one input.

S2N observations

As you can see, inflation is a relatively modern phenomenon in the US.

S2N screener alert

Microsoft announced the laying off of another 14,000 staff as its stock hits an ATH. The market is asleep at the wheel as to the short- to medium-term job loss tsunami coming with the productivity gains from AI.

The Hong Kong dollar maintains a somewhat flexible peg to the US dollar. You can see over the last few years it has been like me trying to fit into clothes that just don’t work with my dad bod. Inevitably, like all things under pressure, it has cracked, a little for now, but it may turn into something more serious.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.