Manufacturing cycle sputtering – Where to go from here?

-

After recovering in early 2024, US and euro PMIs have sputtered lately. Is the manufacturing recovery failing - or just taking a pause?

-

Based on our checklist we believe PMIs should start rising again soon. Asian PMI's have continued to rise, financial conditions have eased, the inventory cycle is still supportive and metal prices have trended higher. These factors normally point to a global manufacturing recovery covering all regions.

-

However, we continue to see an only mild recovery with a peak during the second half of 2024. It is expected to result in moderate goods inflation but not a new surge.

-

As the manufacturing sector is only a small part of the economies, a gradual recovery should not get in the way of central bank easing.

Back in February we argued that the global manufacturing cycle was turning (see Research Global: manufacturing cycle has turned – more to come, 7 February 2024) and we did indeed see signs of that going into the spring months. In April we argued for continued, albeit mild, manufacturing recovery in Research Global – Manufacturing recovery to continue into the summer, 15 April 2024. We have indeed continued to see global PMI manufacturing move higher but this has been driven by markets outside the US and Euro area In recent months manufacturing PMIs in these regions as well as the US ISM manufacturing index have fallen back and cast doubt over the manufacturing recovery. However, looking through our check list for manufacturing activity, we believe the recent weakness is more a pause than a new prolonged set-back. Below we go through the list one by one:

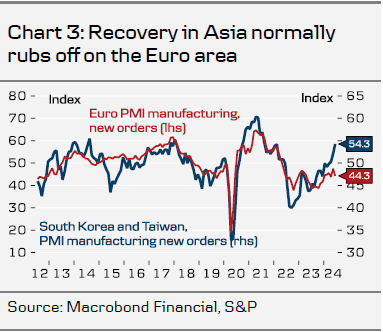

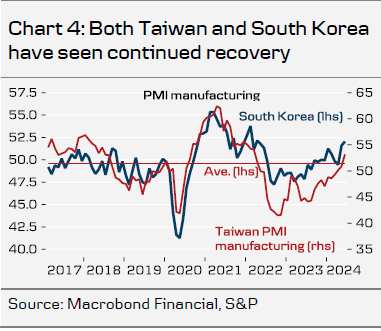

1. Asia PMI: Asia is generally the manufacturing hub of the world with economies like South Korea and Taiwan being key manufacturers of key components that go into manufacturing, not least microchips. The activity signals in these economies tend to give a short lead on manufacturing in Europe (chart 3) as well as the US. PMIs have continued higher in both South Korea and Taiwan in Q2 (chart 4) and the same has been the case in China, another key manufacturing hub. The AI boom and demand for advanced microchips may explain some of the increase in Taiwan and South Korea but that argument does not hold for China suggesting there is more to it than AI chips demand.

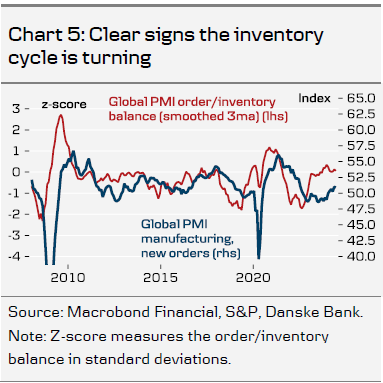

2. Inventory signals: Order-inventory ratios in the PMI statistics tend to provide a short lead on the overall cycle as well. While the ratios across countries have tended to flatline lately, they still indicate there is more ‘catching up’ to do in the actual PMIs (chart 5). The flatlining of the ratio does suggests, though, that the recovery will be mild and peak during the second half of the year.

Author

Allan von Mehren

Danske Bank A/S