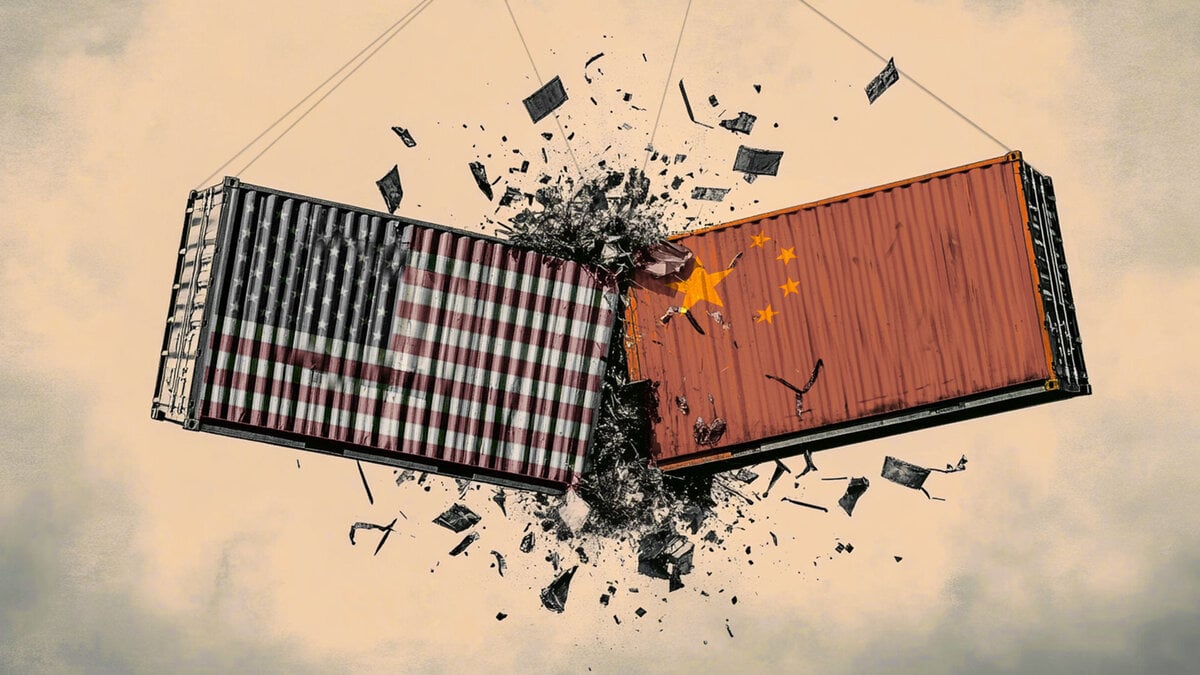

Make magnets, not war: How rare earths just rekindled a toxic romance between China and the US

It’s less a détente, more a truce forged in the trenches — a handshake with one hand on the rare earth throttle and the other clutching a tariff list. China’s rare earth magnet exports to the U.S. didn’t just bounce in June — they rocketed, soaring 660% from May’s cratered lows. That’s not a recovery. That’s a slingshot out of a diplomatic ditch.

Let’s call it what it is: trade by mutual necessity, not mutual affection. With EV production lines twitching and turbine assembly rooms going quiet, the U.S. needed rare earths like a caffeine addict needs a fix. And Beijing? Well, it wanted Nvidia’s silicon sugar back in circulation. So they did what trading nations always do when the ideologues have gone home for the weekend — they cut a deal.

Outbound shipments of magnets from China — the OPEC of rare earths — surged to 353 metric tons in June, a six-fold increase that was less a “bounce back” and more a reminder that when Beijing squeezes the valve, the world feels it in its supply chains. The broader picture showed China shipping over 3,100 tons globally — a big rebound from May, but still well below the levels seen this time last year. That tells you the scars from the spring’s export license clampdown are still healing.

Back in April, China had lobbed a regulatory grenade by slapping rare earth items onto its export restriction list, a tit-for-tat move in response to Washington’s tariff barrage. What followed was a global production hiccup — automakers outside China were forced to idle lines, inventory managers broke out the whiskey, and the market braced for a prolonged squeeze. But cooler heads prevailed, and by June, the paperwork backlog had started to clear.

Now with more licenses in play, July shipments are poised to climb higher — but let’s not confuse resumed flow with restored trust. This is an uneasy symbiosis: the U.S. needs the magnets, China needs the chips, and both sides are trying to pretend that geopolitical rivalry isn’t the elephant in the container yard.

The rare earth rebound is, in short, a tactical ceasefire — not a strategic alliance. But in a world where EVs don’t roll and wind farms don’t spin without neodymium and dysprosium, necessity makes for strange bedfellows. Just don’t expect anyone to let their guard down. The magnets may be flowing again, but the trade war is still very much magnetized.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.